As wealth and standards of living continually increase, so have the methods to flaunt one’s status. Some are opting for metal credit cards over plastic ones, but what's the difference?

It’s always a significant milestone when you acquire your first credit card as an adult. For some, it represents their stepping stone into adulthood, for others, it’s a symbol of status and wealth. Some even take it a step further to request a metal credit card over a plastic one.

Whatever the reason is, metal credit cards certainly appear more enticing than their plastic counterparts. They’re flashy, expensive and act as a form of bragging rights as a premium credit card. But what exactly are the differences between the two? And are metal cards truly more valuable than the others?

Table of contents

- What are metal credit cards?

- Why are metal credit cards popular?

- Differences between plastic and metal credit cards

- Are metal credit cards worth it?

.png?width=800&height=250&name=BEST-DEAL-GUARANTEE_BLOGARTICLE_800x250%20(1).png)

SingSaver's Best Deal Guarantee: Our Best Deal Guarantee promises you the best deal only with SingSaver. If you find a better offer elsewhere, submit a claim, and we'll reward you with double the difference. Valid till 31 July 2025. T&Cs apply.

Origins of metal credit cards

The history of metal credit cards can be traced back to the 1920s, when well-to-do shoppers were using metal charge plates or coins to open tabs at department stores. However, modern-day metal credit cards more recently rose to prominence during the late 1990s: for instance, the titanium American Express Centurion Card was the first of its kind released in 1999.

Source: Forbes

This ultra-sleek, black metal credit card was notoriously fabled as an invite-only card on a need-to-know basis. Only society’s upper echelon was eligible for this legendary card — and even then, it had to be the top of this upper class.

Needless to say, owning an AMEX Centurion Card in your wallet was the definition of opulence and success. And of course, as a testament to the cardholder’s wealth, it culminates in a hefty membership fee to foot annually.

Although the metal card trend isn’t exactly the talk of the town for the common folk, it remains relevant to those affluent enough to afford it. After all, this demographic doesn't shy away from spending big and appreciates the premium perks and benefits that a premium credit card brings for them.

Curious about which metal credit cards available in Singapore you can apply for? We’ve rounded up the best options and compared their cost and benefits so you don’t have to!

The hype surrounding metal credit cards

Despite their high barrier to entry, there's still considerable demand for metal credit cards; in fact, they've become more accessible in recent years.

For starters, the perceived higher prestige and privilege associated with owning a metal credit card act as a strong status symbol to some.

Moreover, a metal credit card is understandably heavier than its plastic counterpart. For instance, a plastic card weighs around one ounce (28g) while a metal card (e.g. AMEX Platinum) can weigh as much as seven ounces (200g).

It’s almost as if there’s a corresponding match in weight tier to the metal card’s costlier annual fees and cost of entry in general. This heftier weight is what contributes to a more elevated, luxurious and premium feel of the card.

What’s more, dishing out a metal card to pay an extravagant restaurant bill in front of family and friends (and the waiter) is impressive.

In terms of customisation, some come in metal-plastic hybrids whereas others are entirely metal plates. The former typically allows easier usage and greater flexibility.

Cardholders can also take things up a notch by choosing between brass, copper, brushed stainless steel, or even gold or platinum, where available. There have even been reports of diamond-encrusted metal cards.

Truly, nothing exudes affluence and lavishness more than a credit card embellished with gemstones.

Read more:

A Full Guide to Priority Banking in Singapore

Priority Banking in Singapore: Does It Help to Grow Your Wealth?

Priority Banking vs. Private Banking: What You Enjoy When You Cross The Last Hurdle

Differences between plastic and metal credit cards

#1: Structural differences

Now, let’s pit the two types of credit cards against each other.

Arguably, the first (and main) difference is that metal credit cards cannot be shredded nor cut with scissors like standard plastic ones.

Attempting to do any will likely result in injury. Instead, the best disposal solution is simply calling ahead to return it to the card issuer.

Another con of metal cards also lies in their relatively less functional usage.

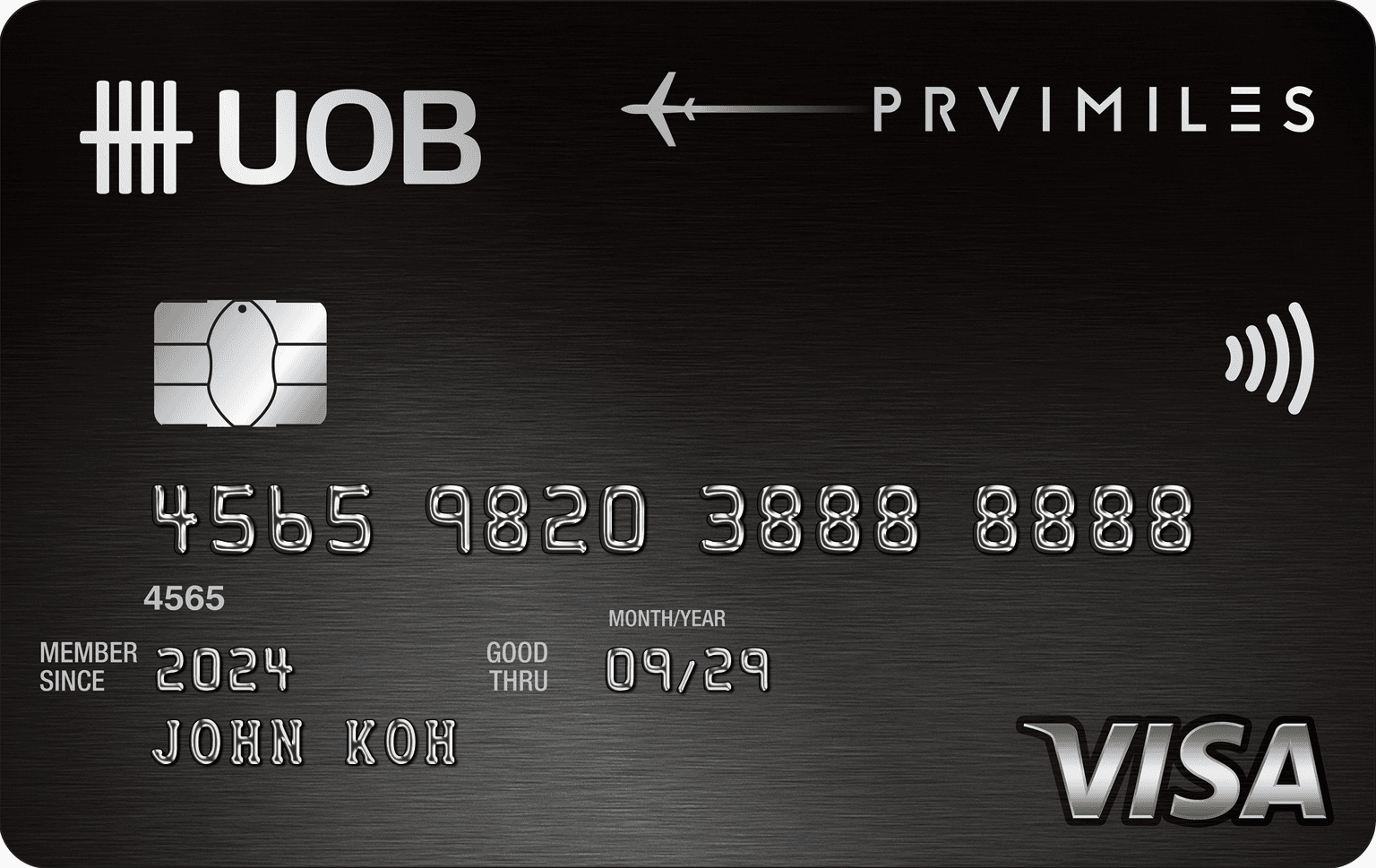

While they can still perform conventional swiping and insertion into chip readers, fully metal or metal veneer cards cannot be used for contactless transactions. This is because such card variations might not possess a PVC on its reverse side.

#2: Featural differences

Overall, Singapore’s credit card industry can be stratified into three segments: S$30,000 tier, S$150,000 tier and S$500,000 tier. These tiers pertain to the cardholder’s minimal income requirements.

S$30,000 tier

You’ll mostly find your plastic credit card options in the S$30,000 segment. Standard annual fees fall under the S$200 range.

S$80,000 to S$150,000 tier

Once you hit S$80,000 and above, you’ll start to see some big leagues like Citi Prestige, OCBC Voyage, and more. Expect your annual fees to range between S$500 to S$700 here. Cardholders can enjoy unlimited lounge access, and complimentary airport transfers, among other special dining and hotel perks.

See also: Cheap and Free Ways to Access Changi Airport Lounges

S$500,000 (& invite-only) tier

One more prong up the ladder and you’ll enter the so-called S$500,000 tier — which has a reputation to be misleading.

Even if you earn an annual income of S$500,000, some of these metal cards are by-invite basis only; and we don’t even want to think about the annual fees unless you consider S$3,000 to be a small ballpark number.

The only redemption for paying the annual four-figure fee is the premium perks offered. They usually comprise bespoke services, beck-and-call concierge assistance, complimentary luxury hotel-chain accommodation, exclusive closed-door events and so much more.

The annual fees cannot be waived for these uber-tiered metal credit cards. They’re all paid upfront as part of the application cost.

💡 Pro-tip: Be sure to compare additional benefits and travel protections across metal credit cards to see which best fits your needs and lifestyles.

Additionally, becoming a priority or private banking member accords cardholders with greater perks to enjoy.

For example, Citi cardholders under Citigold and Citigold Private Client programme can receive up to 30% additional ThankYou Points using the Citi Prestige Card. Points earned are usually calculated based on spending and the extent of a personal relationship with the bank. Here's a breakdown:

Or perhaps if you see yourself as a high-flyer (literally), OCBC Premier, OCBC Premier Private Client and Bank of Singapore VOYAGE Card stand to earn 1.6 miles per local dollar and 2.3 miles per foreign dollar.

To delve deeper into the world of exclusive, invite-only metal credit cards in Singapore, read this article to find out more. 💎

Conclusion: Are metal credit cards worth it?

Apart from stylistic points, substantial weight, and the satisfying metallic clunk of tapping when settling the bill, are metal cards really worth it?

Ultimately, it all boils down to your lifestyle choices. Do you jet-set around the world frequently and want a metal card to score extra miles? Or perhaps you value luxurious experiences and want exclusive access and concierge services for your demands.

Then metal credit cards will be right up your alley.

Otherwise, if they're too excessive or unnecessary to you, regular miles and travel credit cards work just fine too.

Miles & travel credit cards on SingSaver

Choose from our selection of the best miles and travel credit cards to be your next travel companion!

HSBC Revolution Credit Card open_in_new

DBS Woman's World Card open_in_new

DBS Altitude Visa Signature Card open_in_new

DBS Altitude American Express Card open_in_new

Citi PremierMiles Card open_in_new

UOB PRVI Miles World MasterCard open_in_new

UOB PRVI Miles Visa Card open_in_new

UOB PRVI Miles American Express Card open_in_new

Standard Chartered Journey Credit Card (Annual Fee Paying) open_in_new

KrisFlyer UOB Credit Card open_in_new

There’s no right or wrong here, only what your preferences are. Everything is fair game to banks as their valued customer — so long as you meet your credit card’s requirements dutifully.

Read more:

Best Credit Cards For Booking Hotels & Air Tickets

Best Credit Cards With Free Luggage For You To Acquire

Best Credit Cards With Airport Lounge Access

Compare and apply for the best credit cards through SingSaver

Keen on applying for an air miles credit card? Do it through SingSaver and receive additional sign-up bonuses on top of the bank's own welcome gifts! Alternatively, compare the best air miles cards with our handy SingSaver comparison tool to find whichever suits your needs the best.

Similar articles

Why You Should Own a Credit Card in Singapore: 7 Credit Card Benefits You Can Enjoy

4 Types Of Credit Cards With Lifetime Annual Fee Waivers

Klook Promo Codes in Singapore (October 2024): Klook Birthday Travel Sale, up to S$100 Off Sitewide, and more!

How To Pay Income Tax With Credit Cards For Miles & Rewards

When Is A Debit Card More Dangerous than A Credit Card?

5 Reasons to Own a Credit Card in Singapore

Charge Cards Versus Credit Cards in Singapore: What’s the Difference?

Best Bank Of China Credit Cards in Singapore