Guide to Refinancing Student Loans in Singapore

Updated: 11 Apr 2025

Navigating the Singapore education landscape often involves managing student loans—This process allows individuals to potentially secure better interest rates and more favourable terms, easing the burden of education debt, and this guide aims to shed light on the refinancing process, helping Singaporean borrowers navigate the complexities of student loan management.

Written bySingSaver Team

Team

Understanding Student Loan Refinancing in Singapore

Student loan refinance is a financial strategy that can help you manage your education debt more effectively. It involves replacing your existing student loans with a new loan, often with better terms and interest rates.

What is student loan refinancing?

Refinancing allows borrowers to combine multiple loans into a single loan, potentially lowering monthly payments and reducing overall interest costs. This process can be particularly beneficial for those with high-interest private loans or a mix of federal and private loans.

How refinancing differs from consolidation

While both refinancing and consolidation aim to simplify loan repayment, they differ in key ways:

|

Refinancing |

Consolidation |

|---|---|

|

Offered by private lenders |

Typically offered by government |

|

Can lower interest rates |

Maintains weighted average interest rate |

|

Available for private and federal loans |

Usually only for federal loans |

Benefits of refinancing student loans

Refinancing can offer several advantages:

-

Lower interest rates, potentially saving thousands over the loan term

-

Simplified repayment with a single monthly payment

-

Flexibility to choose new loan terms

-

Option to remove co-signers from original loans

By understanding these aspects of student loan refinancing, you can make an informed decision about whether it's the right choice for your financial situation.

Eligibility Criteria for Student Loan Refinancing in Singapore

Refinancing student loans in Singapore requires meeting specific eligibility criteria. Lenders assess various factors to determine if you qualify for better loan terms. Understanding these requirements can help you prepare and increase your chances of approval.

Your credit score plays a crucial role in the refinancing process. A higher score often leads to more favourable interest rates. Most lenders look for a minimum credit score of 650, though some may require higher scores for the best offers.

Income and employment status are equally important. Lenders typically prefer applicants with a stable job and a minimum annual income of S$30,000. Self-employed individuals may need to provide additional documentation to prove their financial stability.

|

Eligibility Factor |

Typical Requirement

|

|---|---|

|

Credit Score |

650 or higher |

|

Annual Income |

S$30,000 minimum |

|

Employment Status |

Stable employment or self-employed with proof |

|

Citizenship |

Singaporean citizen or permanent resident |

Citizenship or residency status is another key factor. Most lenders require applicants to be Singaporean citizens or permanent residents. Some may consider foreigners with valid work permits, but options may be limited.

Lastly, the type and amount of your existing student loans can affect eligibility. Some lenders may have restrictions on refinancing certain types of loans or may have minimum and maximum loan amounts they're willing to refinance.

How to Refinance Student Loans: Step-by-Step Process

Refinancing your student loans can be a smart financial move. The student loan refinance process involves several key steps to ensure you get the best deal. Let's walk through the journey together.

Assessing your current loan situation

Start by taking stock of your existing loans. Make note of the interest rates, remaining balances, and repayment terms. This information will help you determine if refinancing is beneficial for your situation.

Researching lenders and comparing offers

Shop around for lenders offering student loan refinance options in Singapore. Compare interest rates, repayment periods, and any additional perks. Look for lenders with positive customer reviews and flexible terms.

Gathering necessary documents

Prepare the following documents for your application process:

-

Proof of income (payslips or tax returns)

-

Existing loan statements

-

Identification documents

-

Proof of graduation

Submitting your application

Once you've chosen a lender, it's time to submit your application. Fill out the forms accurately and provide all required documents. Most lenders offer online applications, making the process quick and convenient.

Remember, a thorough student loan refinance application process increases your chances of approval and securing favourable terms. Take your time, double-check all information, and don't hesitate to ask questions if anything is unclear.

Read More: Student Loan Repayment Guide

Factors to Consider Before Refinancing Student Loans in Singapore

Before you refinance student loans in Singapore, it's crucial to weigh several key factors. Your current interest rates play a significant role in determining whether refinancing is beneficial. Compare your existing rates with those offered by potential lenders to ensure you're getting a better deal.

The remaining loan balance is another important consideration. If you have a substantial amount left to repay, refinancing might lead to more savings over time. Conversely, if you're close to paying off your loans, the benefits may be less pronounced.

Loan terms are a critical aspect to evaluate. Longer terms might lower your monthly payments but could result in paying more interest overall. Shorter terms might increase monthly payments but could save you money in the long run.

|

Loan Term |

Monthly Payment |

Total Interest Paid |

|---|---|---|

|

5 years |

S$1,887 |

S$13,220 |

|

10 years |

S$1,074 |

S$28,880 |

|

15 years |

S$814 |

S$46,520 |

Don't overlook potential fees associated with refinancing. Some lenders in Singapore may charge application or processing fees. Calculate these costs against your potential savings to determine if refinancing is truly worthwhile.

Lastly, consider your future financial goals. If you're planning major life changes, such as buying a HDB flat or starting a business, refinancing your student loans could impact your ability to secure additional credit.

Read More: Education Financial Assistant Schemes Guide

How to Manage Your Student Loan?

Placeholder: Image + article

Placeholder: Image + article

Placeholder: Image + article

Placeholder: Image + article

Pros and Cons of Student Loan Refinancing in Singapore

Student loan refinance offers both benefits and risks for borrowers in Singapore. Understanding these can help you make an informed decision about your educational debt.

Advantages of refinancing

Refinancing student loans can bring several advantages:

-

Lower interest rates: You might secure a better rate, reducing overall repayment costs.

-

Simplified payments: Combining multiple loans into one can streamline your finances.

-

Flexible terms: Choose repayment periods that suit your financial situation.

-

Potential savings: With lower rates, you could save money over the life of your loan.

Potential drawbacks to consider

Despite the benefits, student loan refinance comes with risks:

-

Loss of government benefits: Refinancing federal loans means forfeiting protections like income-driven repayment plans.

-

Variable rates: If you choose a variable-rate loan, your payments might increase over time.

-

Longer repayment terms: Extended terms can lead to paying more interest overall.

-

Qualification challenges: You need a good credit score and stable income to qualify for the best rates.

Weighing these factors carefully is crucial when considering student loan refinance in Singapore. Your personal financial circumstances will determine whether the benefits outweigh the risks.

Types of Refinancing Options Available in Singapore

When you refinance student loans in Singapore, you'll encounter two primary options: fixed rates and variable rates. Fixed rates offer stability, keeping your interest unchanged throughout the loan term. Variable rates, on the other hand, fluctuate based on market conditions.

Local banks in Singapore provide tailored refinancing products. DBS, for instance, offers education loans with competitive interest rates. OCBC's FRANK Education Loan caters specifically to students and young professionals.

|

Loan Type |

Interest Rate |

Key Feature |

|---|---|---|

|

DBS Education Loan |

4.38%p.a. |

Flexible repayment options |

|

OCBC FRANK Education Loan |

4.5% p.a. |

Grace period post-graduation |

|

UOB Student Loan |

4.28% p.a. |

No early repayment fees |

Some lenders offer hybrid options, combining fixed and variable rates. This structure provides initial stability with potential for future savings. It's crucial to assess your financial situation and risk tolerance when choosing between these refinancing options.

Impact of Refinancing on Credit Score

When considering student loan refinance, it's crucial to understand how it might affect your credit score. The process involves a credit check and opening a new loan account, both of which can impact your credit report.

How refinancing affects your credit report

Refinancing typically results in a hard inquiry on your credit report. This can cause a slight dip in your credit score, usually between 5 to 10 points. The new loan account will also appear on your report, potentially lowering your average account age.

Strategies to minimise credit score impact

To minimise the impact on your credit score, consider these strategies:

Limit applications to a short time frame to reduce multiple hard inquiries

Maintain timely payments on your new refinanced loan

Keep other credit accounts in good standing

Avoid applying for other forms of credit around the same time

Remember, while refinancing may cause a temporary dip in your credit score, responsible management of your new loan can lead to long-term credit improvements. Always review your credit report regularly to ensure accuracy and track your progress.

Common Mistakes to Avoid When Refinancing Student Loans in Singapore

Refinancing student loans can be a smart financial move, but it's crucial to sidestep common pitfalls. Many Singaporean graduates make refinancing errors that could cost them dearly in the long run.

One of the biggest mistakes is failing to compare offers thoroughly. Don't settle for the first refinance option you come across. Take time to explore various lenders and their terms.

Another frequent error is overlooking the fine print. Always read the terms and conditions carefully before you refinance student loans. Pay attention to prepayment penalties and variable interest rates.

Neglecting your long-term financial goals is also a common misstep. Consider how refinancing fits into your overall financial picture, including plans for homeownership or starting a business.

|

Common Refinancing Errors |

Potential Consequences |

|---|---|

|

Not comparing offers |

Missing out on better interest rates |

|

Ignoring terms and conditions |

Unexpected fees or penalties |

|

Forgetting long-term goals |

Hindered financial growth |

|

Refinancing federal loans |

Loss of government benefits |

Lastly, be cautious about refinancing federal student loans. While rates may seem attractive, you could lose valuable government protections and repayment options.

By avoiding these refinancing errors, you can make the most of your decision to refinance student loans and set yourself up for financial success.

Conclusion

Refinancing student loans can be a smart financial decision for many Singaporeans. It offers the potential to lower interest rates, reduce monthly payments, and simplify loan management. But it's not a one-size-fits-all solution.

Before diving into student loan refinance, take time to assess your financial situation. Consider your current loan terms, income stability, and long-term goals. Research different lenders and compare their offers carefully. Remember, refinancing federal loans to private ones may mean losing certain benefits.

Ultimately, the choice to refinance is a personal one. It requires careful thought and thorough analysis. By understanding the pros and cons, and avoiding common pitfalls, you can make an informed decision that aligns with your financial future. Whether you decide to refinance or not, the key is to stay proactive in managing your student loans.

Frequently asked questions

Student loan refinancing involves taking out a new loan with different terms, typically a lower interest rate, to replace one or more existing student loans. This process allows borrowers to potentially save money on interest and simplify their repayment schedule.

Consolidation combines multiple student loans into a single new loan, but it does not necessarily result in a lower interest rate or different repayment terms. Refinancing, on the other hand, involves replacing existing loans with a new loan from a private lender, often with better terms.

The primary benefits of refinancing student loans include securing a lower interest rate, which can save you money over the life of the loan, extending or shortening the repayment term to better suit your financial situation, and simplifying multiple loans into a single monthly payment.

Eligibility requirements vary by lender but typically include having a good credit score, meeting minimum income thresholds, being a Singaporean citizen or permanent resident, and having graduated or left school. Some lenders may have additional criteria.

The refinancing process generally involves assessing your current loan situation, researching and comparing lenders, gathering necessary documentation, submitting an application, and if approved, the new lender will pay off your existing loans, and you'll start making payments on the new loan.

When considering refinancing, evaluate your current interest rates, remaining loan balance, repayment terms, and potential fees. Ensure that the new loan offers better terms than your existing loans and aligns with your long-term financial goals.

Advantages of refinancing include potentially lowering your interest rate, reducing your monthly payment amount, simplifying multiple loans into a single payment, and potentially paying off your loans faster with a shorter repayment term.

Potential drawbacks include losing certain benefits associated with federal student loans, such as income-driven repayment plans or loan forgiveness programmes. Additionally, if you extend your repayment term, you may end up paying more interest over the life of the loan.

Lenders in Singapore may offer fixed-rate or variable-rate refinancing loans. Fixed-rate loans have a consistent interest rate throughout the repayment period, while variable-rate loans fluctuate based on market conditions.

Refinancing typically involves a hard credit inquiry, which can temporarily lower your credit score. However, making on-time payments on the new loan and maintaining a good credit history can help mitigate the impact over time.

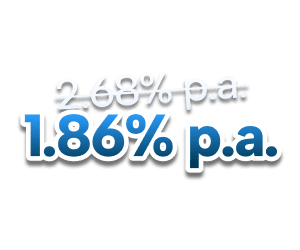

⚡ SingSaver x CIMB Personal Loan Flash Deal ⚡

Enjoy low interest rates from 1.86% p.a. (EIR from 3.56% p.a.) and up to S$400 bonus cash via PayNow, an Apple Watch Series 11 GPS, 42mm with Aluminium Case, or AirPods Pro 3 when you apply for a CIMB Personal Loan! Valid till 2 November 2025. T&Cs apply.

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.