Best Savings Accounts In Singapore To Park Your Money (2025)

updated: Feb 19, 2025

Banks in Singapore are now offering high interest rates in this high-interest climate. This begs the question: which savings account should you stash your cash in right now?

written_by SingSaver Team

With inflation on the rise, the US Fed has been hiking interest rates to bring it down. As a result, banks have followed suit by offering attractive interest rates for their savings accounts.

Indeed, savings accounts like the Standard Chartered Bonus$aver, UOB One, and OCBC 360 have since increased their rates, with some going up to 7.68% p.a. What a time to be alive!

To save you the trouble of looking through all these new interest rates, here’s an easy and up-to-date comparison of the best savings accounts in Singapore.

Note: All savings accounts on this list are insured up to S$100,000 per depositor per Scheme under the Singapore Deposit Insurance Corporation Limited (SDIC).

UPDATE: Mari Savings Account offers up to 2.7% p.a. on your savings with no minimum spend and no salary crediting. Read on to find out what else this fuss-free savings account has to offer.

Table of contents

SingSaver Personal Loans Exclusive Offer

Enjoy up to S$1,599 in cashback or choose rewards from Apple, Dyson, Sony, Nintendo and more when you apply for a personal loan via SingSaver. Plus, earn chances to spin the Madness Wheel and win 50% of your monthly salary & more in our 🎡 March Madness Campaign 🎡 upon signing up! Valid till 31 March 2025. T&Cs apply.

Best savings accounts in Singapore overview: which account has the highest interest rate in Singapore?

Below is the list of savings accounts in Singapore and their interest rates.

Note that achieving the maximum interest rate requires you to meet multiple conditions, such as crediting your salary, maintaining the minimum balance, investing with the bank, making a minimum spend, etc.

|

Savings account |

Maximum interest rate (p.a.) |

Realistic interest rate (p.a.) |

|

Mari Savings Account |

2.5% p.a. |

2.7% p.a. |

|

Standard Chartered Bonus$aver Account |

6.05% |

0.93% |

|

OCBC 360 Account |

7.65% |

2.65% |

|

BOC SmartSaver |

7.00% |

4.30% |

|

UOB One Account |

6.00% |

3.00% |

|

UOB Stash |

5.00% |

0.05% |

|

HSBC Everyday Global Account |

3.90% |

2.85% |

|

DBS Multiplier |

4.10% |

1.80% |

|

Citi Interest Booster |

4.00% |

1.90% |

|

CIMB FastSaver |

5.20% |

1.19% |

|

Maybank Save Up |

4.00% |

1.25% |

|

SIF GoSavers Account |

3.50% |

2.60% |

|

Trust Savings Account |

3.50% |

1.50% (NTUC union member); 1.15% (non-NTUC union member) |

|

GXS Savings Account |

2.68% |

2.68% |

|

Standard Chartered JumpStart |

2.50% |

2.00% |

|

RHB High Yield Savings Plus |

2.00% |

1.50% |

Since each of these savings accounts has different requirements, 'the best' savings account isn't necessarily the one that offers the highest interest rate; it depends on your ability to meet the criteria.

Hence, we've outlined a list of different 'best for' savings accounts for various groups. Check them out below.

Best savings account for salaried workers

Salaried employees in Singapore are spoiled for choice when it comes to high-interest savings accounts. Almost every bank has a savings account that pays bonus interest for crediting your salary and spending on their credit cards.

To find out which is the best savings account for salaried workers, let's say a typical salaried worker:

- Has S$20,000 in savings;

- Credits at least S$2,000 of his/her salary into the savings account each month;

- Spends at least S$500 on a credit/debit card monthly, and;

- Pays at least three bills monthly

Taking the above into account (pun unintended), here's the interest you'll earn from these high-interest savings accounts:

|

Savings account |

Interest earned (p.a.) |

|

4.30% |

|

|

1.90% |

|

|

1.80% |

|

|

1.05% |

|

|

1.25% |

|

|

2.65% |

|

|

1.05% |

|

|

3.00% |

BOC SmartSaver

First up is the BOC SmartSaver Account, which offers one of the highest interest rates at 7.00% p.a.

However, like most savings accounts, you'll need to jump through several hoops to earn bonus interest.

For instance, you'll earn an interest of 2.40% p.a. if you purchase eligible insurance products for a year, 0.80% p.a. if you spend at least S$1,500 on your credit/debit card per month, and 2.50% p.a. for monthly salary crediting of at least S$2,000.

|

Bonus interest category |

Criteria |

Bonus interest (p.a.) |

|

Wealth bonus interest |

Purchase eligible insurance products to earn bonus interest for 12 consecutive months |

2.40% |

|

Card spend bonus interest |

Spend at least S$500 on your debit or credit card in a calendar month |

0.50% |

|

Spend at least S$1,500 on your debit or credit card in a calendar month |

0.80% |

|

|

Salary crediting bonus |

Credit at least S$2,000 of your monthly salary |

2.50% |

|

Payment bonus interest |

Complete at least three bill payments of at least S$30 each via GIRO/ internet banking/ mobile banking bill payment function |

0.90% |

|

Extra savings interest |

Fulfil any one of the requirements for card spend, Salary Crediting or payment bonus interest. |

0.60% |

|

Total |

|

7.00% |

However, note that you need a minimum monthly average balance of S$1,500 to earn bonus interest.

Based on the criteria we've set out above, this is the realistic interest rate you'll earn:

|

Category |

Interest (p.a.) |

|

Base interest (S$1,500 and above) |

0.40% |

|

Card spend bonus interest (at least S$500) |

0.50% |

|

Salary crediting bonus (at least S$2,000) |

2.50% |

|

Payment bonus interest (at least S$30 for three bills) |

0.90% |

|

Total |

4.30% |

BOC SmartSaver

- Minimum initial deposit: S$200

- Minimum monthly balance: S$0 (minimum S$1,500 to earn interest)

- Monthly fall-below fee: S$3

- Bonus interest cap: S$75,000

Citi Interest Booster Account

Citi Plus goes beyond a regular savings account — it's a wealth management platform offering interest up to 4.00% p.a. on your savings with the Citi Interest Booster Account.

With a base interest of 1.50% on your first S$50,000, you can level up your interest rate when you increase your balance, invest with Citibank, purchase an insurance plan policy, take up a mortgage, and more.

|

Criteria |

Interest Rate |

|

Base interest |

1.50% p.a. on your first S$50,000 savings (0.01% p.a. for amounts above S$50,000) |

|

Save Increase your balance by S$1,500 or more |

0.20% p.a. |

|

Spend Spend a minimum of S$500 on eligible retail transactions on your Citibank Debit Mastercard or Citi Cash Back+ Mastercard |

0.20% p.a. |

|

Invest Make three investments of S$1,000 or more |

0.60% p.a. |

|

Insure Policy of minimum S$5,000 regular premium |

0.60% p.a. |

|

Mortgage Home loan of at least S$500,000 |

0.80% p.a. |

|

Birthday Extra interest in the month of your birthday! |

0.10% p.a. |

|

Total Possible |

4.00% p.a. |

Besides that, Citi Interest Booster Account also provides a host of educational materials at your fingertips to learn about anything finance-related and improve your financial literacy. They also offer timely wealth insights and market research to help you make sounder financial decisions.

If you can spend at least S$500 and increase your savings by at least S$1,500 each month (including via salary crediting), you'll earn an additional interest of 0.40% p.a., bumping up your total interest to 1.90% p.a.

Moreover, you can earn up to 2.00% p.a. on your Birthday month, thanks to the Birthday criteria, which rewards you with an extra 0.10% p.a..

Another benefit of the Citi Interest Booster Account is that you can enjoy up to 2% cashback with your Citi Cash Back+ Mastercard (up from the usual 1.6% cashback) or Citibank Debit Mastercard if you spend a minimum of S$500 monthly for a year.

However, the Citi Interest Booster Account requires you to maintain a Total Relationship Balance (TRB) of at least S$15,000 to avoid a S$15 fall-below fee. The good news is that this fee is waived until 31 December 2024.

Citi Interest Booster Account

- Minimum initial deposit: S$0

- Minimum monthly balance: S$15,000

- Monthly fall-below fee: S$15

- Bonus interest cap: S$500,000

DBS Multiplier

The DBS Multiplier Account is one of the most popular savings accounts, if not the most. It offers a maximum interest rate of 4.10% p.a..

Previously, you had to jump through several hoops to get the most out of this savings account:

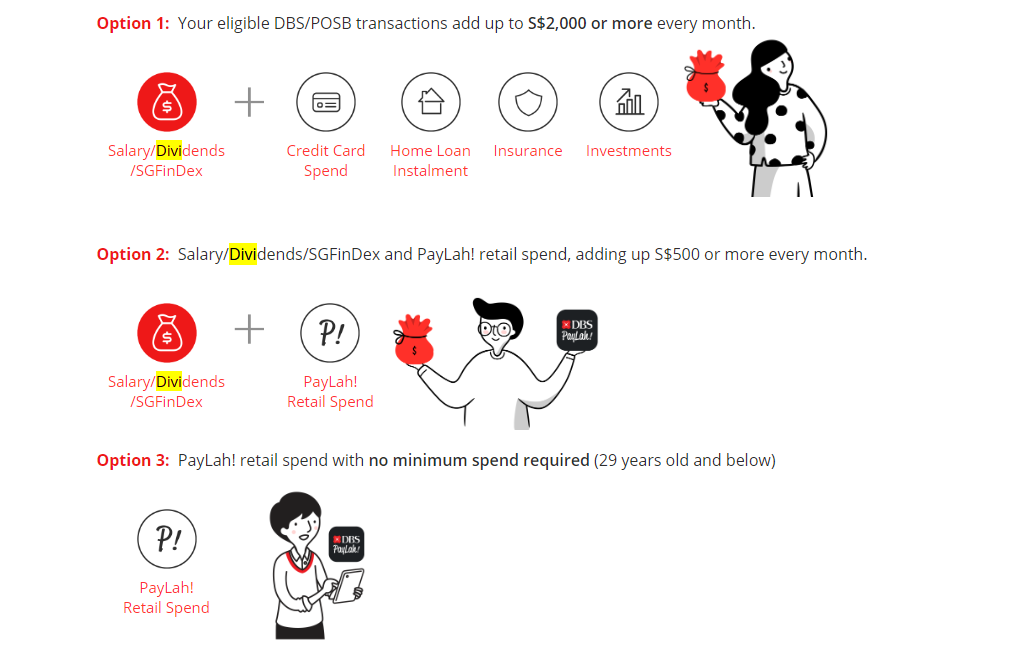

However, DBS made some key changes to the DBS Multiplier Account, including combining credit card/PayLah! retail spend into one and lowering the qualifying DBS/POSB transactions from S$2,000 to S$500, thus making it easier for you to earn higher interest.

Starting from 1 August 2023, here's how you can earn bonus interest:

- Credit your income;

- Transact in one or more categories (credit card/ Paylah! retail spend, home loan instalment, insurance, investments); and

- Spend at least S$500 per month

|

Income + one category |

Income + two categories |

Income + three or more categories |

|

|

Total eligible transactions per month |

First S$50,000 balance |

First S$100,000 balance |

First S$100,000 balance |

|

S$500 or more to below S$15,000 |

1.80% p.a. |

2.10% p.a. |

2.40% p.a. |

|

S$15,000 or more to below S$30,000 |

1.90% p.a. |

2.20% p.a. |

2.50% p.a. |

|

S$30,000 or more |

2.20% p.a. |

3.00% p.a. |

4.10% p.a. |

As you can see, aside from crediting your salary, the premise of the DBS Multiplier Account is based on your transaction amount and the number of categories you transact. The higher the amount and number of transactions, the higher the interest rate.

Note that 'income' includes three categories:

- Salary credit to any DBS/POSB deposit account

- (credit your salary into your DBS/POSB SGD-denominated account via GIRO/FAST/PayNow with transaction code “SAL”/“PAY” or transaction description “SALARY”/“PAYROLL”/“COMMISSION”/“BONUS”) - Dividends credit

- Credit your dividends via GIRO/FAST/PayNow with transaction code “CDP”/“NDIV” or transaction description “DIVIDEND” into your DBS/POSB account, DBS Wealth Management Account, Supplementary Retirement Scheme (SRS) Account or CPF Investment Account (CPFIA)

- Eligible dividends include Central Depository Pte Ltd (CDP), DBS Vickers Securities, DBS Online Equity Trading (OET), DBS Unit Trusts, DBS Online Funds Investing, DBS Invest-Saver. - Annuities

- Credit your CPF payouts or SRS withdrawals via GIRO/FAST/PayNow with transaction code “CPF”/“SRS” or transaction description “CPF”/“SRS” into your DBS/POSB account

In case you're wondering, credit card/ PayLah! retail spend includes any of the following (note that eligible credit card and PayLah! retail spend counts as one category):

Spend with any DBS/POSB personal credit card(s)

- Eligible retail and cash advance transactions made within the calendar month. Note that reversals/credits/refunds posted will offset eligible credit card spend

- Eligible credit card spend across main cards and supplementary cards that are accorded to the main cardholder

Make eligible transactions with PayLah!

- Payments to merchants through PayLah! in-app checkout, web checkout, express checkout

- Scan & Pay transactions

- Payments to billing organisations

- Donations to charitable organisations

To earn the maximum interest of 4.10% p.a. on your first S$100,000, you would need to:

- Credit your income;

- Transact in three categories or more; and

- Spend at least S$30,000

But suppose you fulfil our criteria (S$10,000 savings, credit your monthly salary, spend at least S$500), you'll earn 1.80% p.a. on your first S$50,000.

DBS Multiplier

- Minimum initial deposit: S$0

- Minimum monthly balance: S$3,000

- Monthly fall-below fee: S$5 (waived if you're below 29 years old or if you're a new DBS/POSB customer)

- Bonus interest cap: S$100,000

HSBC Everyday Global Account (EGA)

The HSBC EGA is a multi-currency account that lets you hold, withdraw, exchange, and transact foreign currencies. At the time of writing, you can transact in 11 different currencies and withdraw cash in 10 different currencies at S$0 fees.

There's currently a promotion from 1 to 28 February 2025 where new and existing HSBC customers can earn up to 3.90% p.a. bonus interest on their HSBC EGA when they register via SMS:

- Up to 2.85% p.a. HSBC EGA bonus interest

- 0.05% p.a. HSBC EGA's prevailing interest rate

- 1.00% p.a. when you qualify for the Everyday+ Rewards Programme

|

Customer segment |

Prevailing interest rate (p.a.) |

Bonus interest rate (p.a.) |

Total interest rate (p.a.) on incremental average daily balance (ADB) |

|

Incremental average daily balance (ADB) < S$2,000,000 |

0.05% |

2.75% |

2.80% |

|

Incremental average daily balance (ADB) ≥ S$2,000,000 |

0.05% |

2.85% |

2.90% |

Note that the bonus interest rate of up to 2.85% p.a. will only be earned during the months of February and March 2025. Additionally, the additional bonus interest is applicable up to a maximum top-up of S$2 million. The top-up amount in deposits is compared against the reference month of January 2025.

For example, if you have an average daily balance (ADB) of S$200,000 in February 2025 and S$10,000 in January 2025 (Reference Month), the incremental ADB that will earn bonus interest is S$190,000.

|

Month |

Deposits ADB |

|

January 2025 (reference month) |

S$10,000 |

|

February 2025 |

S$200,000 |

|

Incremental ADB that will earn bonus interest |

S$190,000 |

Eligible customers who satisfy all the conditions of the promotion will receive the bonus interest by 30 April 2025.

|

Bonus interest earning period |

Fulfillment date |

|

Existing customers who already hold an eligible account from 1 to 28 February 2025 |

By 31 May 2025 |

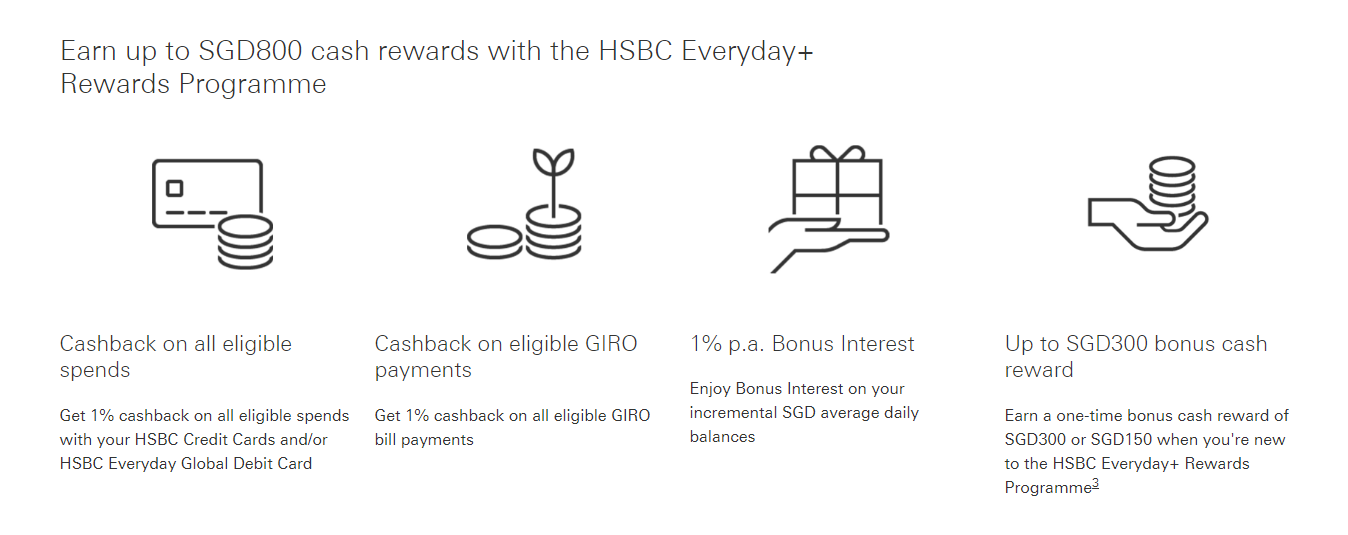

On top of the HSBC EGA bonus interest, you can also earn 1% additional bonus interest and 1% cashback when you qualify for the HSBC Everyday+ Rewards programme:

- 1% cashback on all eligible spends with your HSBC Everyday Global Debit Card or eligible GIRO bill payments from your EGA (capped at S$300 each month)

- 1% additional bonus interest on your incremental SGD average daily balances (capped at S$300 each month)

To qualify for the HSBC Everyday+ Rewards programme, you must:

HSBC Premier customers

- Deposit at least S$5,000 into your account via salary crediting every month and/or inward transfers from a non-HSBC bank account and make at least five eligible transactions via the HSBC Everyday Global Debit Card. (no minimum spend) monthly

HSBC Personal Banking customers

- Deposit at least S$2,000 into your account via salary crediting every month and/or inward transfers from a non-HSBC bank account and make at least five eligible transactions via the HSBC Everyday Global Debit Card (no minimum spend) monthly.

So, if you meet all the criteria above, you'll earn a total of up to 2.85% p.a. interest.

However, you can bump up the interest earned to 3.90% p.a. via the additional 1% bonus interest when you qualify for the Everyday+ Rewards Programme.

In addition, you'll also get an additional 1% cashback on the payment amount for any GIRO bill payments (capped at S$300 per month).

There is also a one-time cash bonus reward of S$300 for new HSBC Premier Customers and S$150 for new HSBC Personal Banking customers.

But the catch is that you must maintain at least S$200,000 if you're an HSBC Premier customer or S$100,000 if you're an HSBC Personal Banking customer. The deposits must be maintained for at least six months.

HSBC EGA

- Minimum initial deposit: S$2,000

- Minimum daily balance: S$2,000

- Monthly fall-below fee: S$5

- Bonus interest cap: S$5,000

Maybank Save Up Account

Starting from 1 June 2023, existing Maybank Save Up Account members can earn up to 4.00% p.a. on their first S$75,000:

|

Base interest of up to 0.25% p.a. |

|||

|

Bonus interest when you |

Take up one product |

Take up two products |

Take up three or more products |

|

First S$50,000 |

0.30% p.a. |

1.00% p.a. |

2.75% p.a. |

|

Next S$25,000 |

1.00% p.a. |

1.50% p.a. |

3.75% p.a. |

|

Maximum effective interest rate (EIR) |

0.53% p.a. |

1.17% p.a. |

3.08% p.a. |

The Maybank Save Up Programme offers a base interest of up to 0.25% p.a., and you can earn bonus interest based on the products that you take up (up to nine):

|

Qualifying products |

Minimum transaction amount |

Bonus interest period |

|

|

Save |

GIRO payment* (to other billing organisations) and/or Salary crediting* (via GIRO or Maybank payroll) |

S$300 monthly (GIRO) |

One month |

|

Spend |

Card (transact with Maybank Platinum Visa Card and/or Horizon Visa Signature Card) |

S$500 |

One month |

|

Invest |

Structured deposits |

S$30,000 |

Three months |

|

Unit trusts |

S$25,000 cash investments |

12 months |

|

|

Insure |

Regular premium insurance |

S$5,000 in annual premium |

12 months |

|

Borrow |

Home loan (excludes equity loan) |

S$200,000 |

12 months |

|

Car loan |

S$35,000 |

12 months |

|

|

Renovation loan |

S$10,000 |

12 months |

|

|

Education loan |

S$10,000 |

12 months |

To earn the maximum interest rate, you would need to take up at least three products. For instance, spending, saving, and investing with the bank would earn you 2.75% p.a. on your first S$50,000.

But suppose that you meet the criteria that we've set out (credit at least S$2,000 of your salary and spend a minimum of S$500 monthly), you’ll earn an interest of 1.25% p.a. on the first S$50,000 in your account:

|

Base interest |

0.25% p.a. |

|

Take up two products (spend S$500 and credit at least S$2,000 of your salary monthly) |

1.00% p.a. |

|

Total interest |

1.25% p.a. |

*If you meet the minimum salary credit amount and/or the minimum aggregate GIRO debit amount stated in the table above, it will be considered one Qualifying Product.

Maybank Save Up

- Minimum initial deposit: S$500 (Singaporeans/Singapore PRs), S$1,000 (foreigners)

- Minimum monthly balance: S$1,000

- Monthly fall-below fee: S$2 (waived if you're below 25 years old)

- Bonus interest cap: S$50,000

OCBC 360

Have an OCBC credit card and use your OCBC 360 Account for salary crediting?

You'll earn an effective interest rate (EIR) of up to 4.65% p.a. interest on the OCBC 360 savings account for the first S$100,000 if you fulfil the salary, saving, and spending requirements.

You can also earn an additional 3.00% p.a. when you buy insurance or investment products with the bank, to a maximum interest rate of up to 7.65% p.a.!

Here’s a breakdown of the OCBC 360 Account bonus interest rates:

|

Account balance

|

Salary (monthly salary credit of at least S$1,800 through GIRO/PayNow)

|

Save (increase your average daily balance by at least S$500 monthly)

|

Spend at least S$500 of selected OCBC credit cards each month

|

Purchase an eligible insurance product from OCBC

|

Purchase an eligible investment product from OCBC

|

Maintain an average daily balance of at least S$200,000

|

|

First S$75,000

|

2.00%

|

1.20%

|

0.60%

|

1.20%

|

1.20%

|

2.40%

|

|

Next S$25,000

|

4.00%

|

2.40%

|

2.40%

|

2.40%

|

||

|

Effective interest rate (EIR)*

|

2.50%

|

1.50%

|

0.60%

|

1.50%

|

1.50%

|

2.40%

|

*You will earn a base interest of 0.05% a year on your entire account balance regardless of whether you fulfil the above categories.

For maximum EIR illustration purposes for your first S$100,000:

Salary + Save: You will earn a maximum EIR of 4.05% a year.

Salary + Save + Spend: You will earn a maximum EIR of 4.65% a year.

Salary + Save + Spend + Insure / Invest: You will earn a maximum EIR of 6.15% a year.

Salary + Save + Spend + Insure + Invest: You will earn a maximum EIR of 7.65% a year.

Based on the criteria that we've set out, this is how much you can earn through the OCBC 360 Account:

|

Criteria |

Interest rate (p.a.) |

|

Credit at least S$1,800 of your monthly salary through GIRO/PayNow |

2.00% |

|

Spend at least S$500 a month on selected OCBC credit cards |

0.60% |

|

Base interest |

0.05% |

|

Total |

2.65% |

You can, however, bump up the bonus interest rate earned by 1.20% p.a. to a total of 3.85% p.a. if you increase your monthly average balance by at least S$500 monthly.

Note that eligible OCBC Cards include the OCBC 365, OCBC NXT, OCBC 90°N or OCBC Titanium Rewards Credit Card.

OCBC 360

- Minimum initial deposit: S$1,000

- Minimum monthly balance: S$3,000

- Monthly fall-below fee: S$2 (waived for the first year)

- Bonus interest cap: S$100,000

Standard Chartered Bonus$aver

There used to be a longstanding three-way fight between the DBS Multiplier, UOB One and OCBC 360 accounts in this category.

But Standard Chartered Bonus$aver Account has finally caught up and taken the cake for this category. And while the rates have tapered off slightly from the 7.68% p.a. it used to offer, the maximum 6.05% p.a. interest is still among the highest of all the savings accounts.

Here's how you can earn the maximum 6.05 % p.a. interest rate on your first S$100,000:

|

Criteria |

Bonus interest (p.a.) |

|

Base interest |

0.05% |

|

Spend |

At least S$1,000 on your Bonus$aver credit/debit card (1.00%) |

|

Monthly salary credit |

At least S$3,000 (1.00%) |

|

Invest |

Invest in eligible unit trust products with a minimum subscription sum of S$30,000 for 12 months (2.00%) |

|

Insure |

Purchase an eligible insurance policy with an annual premium of S$12,000 for 12 months (2.00%) |

To maximise the interest earned, you'll need to spend at least S$2,000 on an eligible credit/debit card to get an additional 1%.

Crediting your salary of S$3,000 and above will also give you an extra 1.00% p.a. interest. To cap it off, investing and insuring with Standard Chartered will give you a bonus interest of 2.00% p.a. each.

Take note that you do need to maintain a minimum daily balance of S$3,000 to avoid a S$5 fall-below fee.

So, while the 6.05% interest p.a. is eye-catching, what's the realistic interest rate you can earn?

Well, based on the criteria that we've laid out above, if you spend at least S$1,000 on a credit/debit card monthly, then you can increase it to 1.05%. Plus, if you can credit at least S$3,000 of your monthly salary, you're looking at an additional 2.00% p.a. interest, bumping up your interest to 2.05% p.a.

Standard Chartered Bonus$aver

- Minimum initial deposit: S$0

- Minimum monthly balance: S$3,000

- Monthly fall-below fee: S$5

- Bonus interest cap: S$100,000

UOB One Account

The UOB One Account offers up to 6.00% p.a. interest rate.

Unlike most savings accounts which require you to fulfil three to four conditions to earn a higher interest rate, you can achieve this with the UOB One Account in just two conditions:

- Spend a minimum of S$500 on an eligible UOB Card

- Credit your monthly salary of at least S$1,600 via GIRO/PayNow in each calendar month/make at least three GIRO transactions per calendar month

|

Account monthly average balance |

Spend min. S$500 in a calendar month on an eligible UOB card Total interest (p.a.) |

Spend min. S$500 in a calendar month on an eligible UOB Card and make three GIRO debit transactions Total interest (p.a.) |

Spend min. S$500 on eligible UOB Card AND credit your salary via GIRO |

|

First S$75,000 |

0.65% |

2.00% |

3.00% |

|

Next S$50,000 |

0.05% |

3.00% |

4.50% |

|

Next S$25,000 |

0.05% |

0.05% |

6.00% |

|

Above S$150,000 |

0.05% |

0.05% |

0.05% |

Based on the criteria we've outlined, just by spending a minimum of S$500 on your eligible UOB card and crediting at least S$1,600 of your salary via GIRO each month, you'll earn a total of 3.00% p.a. on your first S$75,000, which includes a base interest rate of 0.05% p.a..

Note that eligible UOB cards include the following: UOB One Card, UOB Lady’s Cards (all card types), UOB EVOL Card, UOB One Debit Visa Card, UOB One Debit Mastercard, UOB Lady’s Debit Card and UOB Mighty FX Debit Card.

UOB One

- Minimum initial deposit: S$1,000

- Minimum daily balance: S$1,000

- Monthly fall-below fee: S$5 (waived for the first six months for accounts opened online)

- Bonus interest cap: S$150,000

Best savings accounts without salary credit

Individuals without regular salaries — freelancers, gig workers, landlords, retirees, stay-at-home parents — need not be left out of the high-interest savings account game. However, you might need to be creative with how you earn bonus interest on your savings account.

For simplicity’s sake, let’s assume you are a freelance writer. You don’t have a regular paycheck, but you spend at least S$500 per month on your credit/debit card and bills. How much can you earn on your S$20,000 savings stash in that case? Check out the best options below.

|

Savings account |

Interest/rewards earned |

|

2.5% p.a. |

|

|

2.68% p.a. |

|

|

2.60% p.a. |

|

|

1.50% p.a. |

|

|

2.00% p.a. |

|

|

2.00% p.a. |

|

|

1.19% p.a. |

|

|

1.80% p.a. |

|

|

1.50% p.a. |

|

|

UOB Stash |

0.05% p.a. |

UPDATE: Mari Savings Account

For those of you who prefer fuss-free interest on your savings without hoops to jump through, this savings account might be right up your alley.

The Mari Savings Account stands out with its simple and straightforward premise. You'll earn 2.5% p.a. interest on your savings, with no minimum balance or qualifying card transactions.

This comes as a welcome breath of fresh air for anyone who's weary of having to make sure they make the right type of transactions or spend a minimum sum each month.

Importantly, the Mari Savings Account offers one of the highest interest rates among bank accounts that do not require salary crediting.

Additionally, the Mari Savings Account earns daily interest, which means you'll see a steady stream of interest credited to your account every day. Daily interest is calculated based on your previous day's balance.

Depending on your preferences, you might find this to be a more satisfying way to earn interest rather than the traditional way -- i.e., credited once a month.

Other benefits:

Avid online shoppers will love that the Mari Savings Account offers seamless payment on Shopee. Simply link your Mari Savings account to check out and pay on your Shopee app, or top-up your ShopeePay wallet with your account balance. You'll enjoy exclusive Shopee rewards on payments made this way.

Additionally, the Mari Savings Account supports PayNow transactions, allowing you to send and receive money instantly. You can also make payments at merchants that accept PayNow QR codes.

Mari Savings Account

- Minimum initial deposit: S$0

- Minimum monthly balance: S$0

- Monthly fall-below fee: S$0

- Bonus interest cap: NIL

CIMB FastSaver

The CIMB FastSaver Account is for those who prefer a simple savings account that doesn't require you to meet different requirements to earn a higher interest. In fact, all you need to do is to park your money!

Because, unlike most savings accounts, you don't have to fulfill different requirements to unlock higher interest, whether it’s signing up for a credit card, investing in an insurance product, or meeting a monthly minimum spend. All you need to do is increase your account balance.

You'll earn 1.19% p.a. on your first S$25,000, 2.19% p.a. on your first S$50,000, and 3.30% p.a. on your first S$75,000. However, for amounts above S$75,000, the interest rate drops to a meagre 0.80% p.a.

|

Account balance |

Prevailing interest rates (p.a.) |

Additional interest/profit rate (p.a.) when you credit your salary or schedule a recurring transfer of min. S$1,000 |

Additional Interest Rate (p.a.) when you spend on your CIMB Visa Signature Credit Card |

|

First S$25,000 |

1.19% |

0.50% |

|

|

Next S$25,000 |

2.19% |

-

|

|

|

Next S$25,000 |

3.30% |

||

|

Above S$75,000 |

0.80% |

So, you can get additional interest of 0.50% p.a. on the first S$25,000 when you credit your monthly salary or schedule a GIRO transfer (minimum S$1,000)

In other words, you'll need to credit your salary or schedule a recurring transfer of min. S$1,000 to earn a bonus interest of 0.50% p.a., in addition to the 1.19% p.a. interest on your first S$25,000. And if you have a CIMB Visa Signature Credit Card and spend at least S$300, you'll get +1.00% bonus interest.

Aside from that, another benefit of the CIMB FastSaver Account is there's no lock-in period or monthly fall-below fees. However, you do need a minimum of S$1,000 to start the account and maintain a monthly average balance of S$1,000 to earn interest.

Still, based on our criteria above (S$25,000 in savings), you'll earn 1.19% p.a. interest, which is a good return considering that there are no hoops to jump through.

CIMB FastSaver

- Minimum initial deposit: S$1,000

- Minimum monthly balance: S$0 (minimum S$1,000 to earn interest)

- Monthly fall-below fee: S$0

- Bonus interest cap: NIL

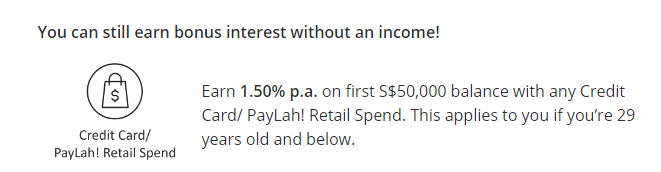

DBS Multiplier

The DBS Multiplier Account offers 1.80% p.a. interest on your first S$50,000 without crediting your monthly income.

All you need to do is spend with a DBS credit card or make a PayLah! retail spend. However, this is only for those 29 years old and below.

You can also reach up to 4.1% for your first S$100,000 with total eligible transactions of at least S$30,000 of three categories. Learn more about how it works below:

| Income deposit + transactions in 1 eligible category | Income deposit + transactions in 2 eligible categories | Income deposit + transactions in at least 3 eligible categories | |

| Total eligible transactions per month | First S$50,000 balance | First S$100,000 balance | First S$100,000 balance |

| From S$500 to less than S$15,000 | 1.80% p.a. | 2.10% p.a. | 2.40% p.a. |

| From S$15,000 to less than S$30,000 | 1.90% p.a. | 2.20% p.a. | 2.50% p.a. |

| At least S$30,000 | 2.20% p.a. | 3.00% p.a. | 4.10% p.a. |

Categories for eligible transactions include:

- Credit Card/Paylah! Retail Spend

- Home Loan Instalment

- Insurance

- Investments

DBS Multiplier

- Minimum initial deposit: S$0

- Minimum monthly balance: S$3,000

- Monthly fall-below fee: S$5 (waived if you're below 29 years old or if you're a new DBS/POSB customer)

- Bonus interest cap: S$100,000

GXS Savings Account

GXS Savings Account is a savings account by GXS Bank (a joint consortium between Singtel and Grab).

The GXS Savings Account comprises a Main Account and eight Saving Pockets which can be allocated for different savings goals (education, loans, renovation, holiday, etc.).

The interest rate for the main account is 2.38% p.a., while each Savings Pocket will earn you 2.68% p.a..

|

Account |

Interest rate (p.a.) |

|

Main account |

2.38% |

|

Savings Pocket(s) |

2.68% |

What sets the GXS Savings Account apart from other savings accounts is that the interest is credited daily. In other words, you can withdraw your money at any point in time without having to worry about losing out on the interest (which is unlike most savings accounts where the interest is based on your average daily balance).

Also, while the maximum you can hold in your account is S$75,000, the funds in your account will continue to earn interest.

Moreover, there are no hoops to jump through, meaning you can earn interest from your first dollar without needing to meet a monthly credit card spend, credit your salary, or buy an insurance or investment product. You also don't need to maintain a minimum balance or commit to a lock-in period.

GXS savings account also comes with a complimentary debit card, where you'll earn rewards when you spend at least S$10 on eligible transactions.

GXS Savings Account

- Minimum initial deposit: S$0

- Minimum daily balance: S$0

- Monthly fall-below fee: S$0

- Bonus interest cap: S$75,000

Also read: 5 Reasons Why A GXS FlexiLoan Can Be Beneficial For You

RHB High Yield Savings Plus

If you want a no-frills account that doesn't require jumping through hoops to earn bonus interest, the RHB High Yield Savings Plus Account is for you.

The RHB High Yield Savings Plus Account works like a traditional savings account where the interest earned is based on the funds you have in the account. The highest interest you can earn is 2.00% p.a. for deposits above S$100,000.

|

Deposit balance amount |

Interest rates (p.a.) |

|

First S$50,000 |

1.50% |

|

Next S$25,000 |

1.60% |

|

Next S$25,000 |

1.80% |

|

Above S$100,000 |

2.00% |

Since there's no bonus interest for credit/debit card transactions, you'll earn 1.50% p.a. interest on the first S$50,000 in your account based on our criteria.

RHB High Yield Savings Plus

- Minimum initial deposit: S$1,000

- Minimum daily balance: S$0

- Monthly fall-below fee: S$0

- Bonus interest cap: S$100,000

Sing Investments & Finance Limited (SIF) GoSavers Account

The SIF GoSavers Account is another savings account that pays you a high interest without requiring salary crediting. Indeed, all you need is to park your savings to enjoy up to 3.50% p.a.

You’ll earn 2.60% p.a. on your first S$300,000, 3.00% p.a. on your next S$300,000, and 3.50% p.a. on amounts above S$1,000,000.

This makes the SIF GoSavers Account a good option for students, homemakers, retirees, freelancers, and National Servicemen (NSFs) who want a simple savings account without jumping through hoops. It's also great for those with large account balances, as you can earn 2.25% p.a. interest for balances S$1,000,000 and above.

|

Account balance |

Interest rate (p.a.)* |

|

First S$300,000 |

2.60% |

|

Next S$300,000 |

2.75% |

|

Next S$300,000 |

3.00% |

|

Next S$100,000 |

3.50% |

|

Above S$1,000,000 |

2.25% |

What's more, there's no early account closure fee, no minimum initial deposit requirement, and the interest is calculated based on your daily balances (and credited at the end of the month), so you can withdraw your money at any point in time without worrying about losing interest.

SIF GoSavers Account

- Minimum initial deposit: S$0

- Minimum daily balance: S$1,000

- Monthly fall-below fee: S$2

- Bonus interest cap: S$250,000

Standard Chartered JumpStart

If you're a student or a young working adult who wants a no-frills savings account to store your funds, the Standard Chartered JumpStart Account is worth considering; it offers an interest of 2.00% p.a. for your first S$50,000 without jumping through hoops.

However, you'll only earn 0.10% p.a. interest for account balances above S$50,000.

|

Account balance |

Prevailing interest rate |

|

First S$50,000 |

2.00% p.a. |

|

Any incremental balances above S$50,000 |

0.50% p.a. |

Besides that, you'll get an additional 1.00% cashback (capped at S$60 per calendar month) when you spend on your Standard Chartered Mastercard debit card. You'll also earn a step-up interest of 0.50% p.a., provided you invest in an investment product with the bank (unit trusts, Regular Savings Plan, or equities through SC Online Trading).

So, going with our criteria, you would earn 2.00% interest p.a. on your first S$50,000.

The Standard Chartered JumpStart Account is open for those between the ages of 18 to 26 years old. There's no lock-in period, monthly minimum spend, service or annual fee for the cashback debit card, and requirement for monthly salary crediting.

Standard Chartered JumpStart Account

- Minimum initial deposit: S$0

- Minimum daily balance: S$0

- Monthly fall-below fee: S$0

- Bonus interest cap: S$50,000

Trust Savings Account by Standard Chartered X FairPrice Group

In light of the rising interest rates, Standard Chartered and FairPrice Group have launched their very own Trust Savings Account. From 1 June 2024, The Trust Savings Account earns you an interest rate of up to 3.00% p.a. on your first S$800,000.

This comprises a base interest of 0.75% p.a. with no conditions and a spend bonus interest of 0.75% p.a. (union member) or 0.40% p.a. (non-union member) if you make at least five eligible transactions with your Trust card every month, a balance bonus interest of 0.75% p.a. with S$100,000 average daily bonus (ADB) for the month, and a 0.75% p.a. salary bonus interest when you credit a salary of at least S$1,500 in a single transaction through GIRO in a month.

However, note that the base interest drops to 0.05% p.a. for amounts above S$800,000.

|

Criteria |

Interest rate (p.a.) |

|

Base interest (first S$750,000) |

0.75% |

|

Spend bonus interest (first S$800,000) |

0.75% (NTUC union member) |

|

Balance bonus interest (minimum ADB of S$100,000) |

0.75% |

|

Salary bonus interest |

0.75% |

|

Total |

3.00% (NTUC union member) |

The Trust Savings Account also doesn't require a minimum balance, fall-below fee, lock-in period, account closure fee, foreign transaction fee, and card replacement fee — they pride themselves in being a fee-less savings account!

So, based on our criteria, the maximum interest you can earn as an NTUC union/non-union member is:

|

Criteria |

Interest rate (p.a.) |

|

Base interest (first S$800,000) |

0.75% |

|

Spend bonus interest (first S$800,000) |

0.75% (NTUC union member) |

|

Total |

1.50% (NTUC union member) |

Additionally, NTUC Union members can enjoy up to 21% savings (2.5% base rate + 6% monthly bonus + 10.5% quarterly bonus + 2% annual bonus) on FairPrice Group (FPG) groceries and food spend if you spend at least S$350 monthly with your NTUC Link Credit Card.

Meanwhile, NTUC Union members who spend a minimum of S$200 with the NTUC Link Debit Card will get to enjoy up to 11% in savings (2.5% base rate + 1% monthly bonus + 5.5% quarterly bonus + 2% annual bonus).

Non-NTUC Union members with the Trust Link Credit Card can enjoy up to 15% savings (0.5% base rate + 5% monthly bonus + 9.5% quarterly bonus) on FPG groceries and food when you meet a monthly minimum eligible spend of S$400.

Lastly, you'll also get to enjoy up to 5% savings (0.5% base rate + 1% monthly bonus + 3.5% quarterly bonus) on FPG groceries and food if you spend at least S$200 per month outside of FPG with the Trust Link Debit Card.

Trust Savings Account

- Minimum initial deposit: S$0

- Minimum daily balance: S$0

- Monthly fall-below fee: S$0

- Bonus interest cap: S$125,000

UOB One

While you do earn bonus interest for crediting your monthly salary, the UOB One Account also emerges as one of the best savings accounts without salary crediting; you can earn up to 2.00% p.a. interest on your first S$73,000 simply by spending S$500 with an eligible UOB card and making three GIRO debit transactions.

|

Account monthly average balance |

Spend min. S$500 in a calendar month on an eligible UOB card Total interest (p.a.) |

Spend min. S$500 in a calendar month on an eligible UOB Card and make three GIRO debit transactions Total interest (p.a.) |

Spend min. S$500 on eligible UOB Card AND credit your salary via GIRO |

|

First S$75,000 |

0.65% |

2.00% |

3.00% |

|

Next S$50,000 |

0.05% |

3.00% |

4.50% |

|

Next S$25,000 |

0.05% |

0.05% |

6.00% |

|

Above S$150,000 |

0.05% |

0.05% |

0.05% |

In short, the interest rate will be 2.00% p.a. on your first S$30,000 when you fulfil the two criteria (spend at least S$500 on eligible UOB cards and make three GIRO debit transactions).

UOB One

- Minimum initial deposit: S$1,000

- Minimum daily balance: S$1,000

- Monthly fall-below fee: S$5 (waived for the first six months for accounts opened online)

- Bonus interest cap: S$150,000

Switching to the UOB One Account for its simple bonus interest structure? You'll need to pick up a UOB credit card to pair it with.

UOB Stash

Unlike the UOB One Account, the UOB Stash Account works more like a traditional savings account.

You'll earn a base interest of 0.05% p.a. and a bonus interest of up to 4.95% p.a., depending on the amount you have in your bank account. However, you'll only earn 0.05% p.a. interest on your first S$10,000.

To earn the highest total interest of 5.00% p.a., you'll need to have a total of S$100,000 in your bank account. However, do note that any amount above S$100,000 will not grant you bonus interest.

|

Monthly average balance |

Base interest (p.a.) |

Bonus interest (p.a.) |

Total interest (p.a.) |

|

First S$10,000 |

0.05% |

0% |

0.05% |

|

Next S$30,000 |

0.05% |

1.95% |

2.00% |

|

Next S$30,000 |

0.05% |

2.95% |

3.00% |

|

Next S$30,000 |

0.05% |

4.95% |

5.00% |

|

Above S$100,000 |

0.05% |

0% |

0.05% |

To earn the bonus interest, you have to fulfil these two conditions:

- Maintain or increase your previous month's Monthly Average Balance (MAB)

- Maintain a minimum MAB of S$10,000 (for bonus interest)

UOB Stash

- Minimum initial deposit: S$1,000

- Minimum daily balance: S$1,000

- Monthly fall-below fee: S$2 (waived for the first six months for accounts opened online)

- Bonus interest cap: S$100,000

Reviews of savings accounts in Singapore

Read reviews of the various savings accounts in Singapore and what each account has to offer to find the best product for your needs:

- Read the OCBC 360 Savings Account Review

- Read the UOB One Account Review

- Read the DBS Multiplier Account Review

- Read the Maybank Save Up Programme Review

- Read the CIMB FastSaver Savings Account Review

- Read the CIMB StarSaver Savings Account Review

- Read the Standard Chartered Bonus$aver Review

- Read the POSB Save As You Earn (SAYE) Account Review

- Read the OCBC FRANK Savings Account Review

- Read the UOB Lady’s Savings Account Review

- Read the KrisFlyer UOB Savings Account Review

- Read the HSBC Everyday Global Account Review

about_the_author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.