HSBC Revolution Credit Card Review: For Low Spenders Who Want Flexible Rewards

updated: Dec 10, 2024

Earn up to 9,000 bonus points (or 4,000 miles) every month and redeem, air miles, cashback, vouchers and products.

written_by SingSaver Team

[Update] With effect from 15 July 2024, the HSBC Revolution Card will no longer reward 9X bonus rewards points on contactless transactions. Meanwhile, eligible travel-related transactions will still be rewarded 9X bonus rewards points until 31 December 2024.

From 15 July 2024: No more 9X bonus rewards points on contactless transactions

From 1 Jan 2025: No more bonus 9X bonus rewards on travel-related transactions

Love earning bonus rewards points but can’t seem to find anything worth redeeming your points for? Well, with the HSBC Revolution Card, this won’t likely be a problem.

That’s because you’ll have plenty of choice in where to put your points. Choose from everyday treats like Starbucks vouchers or popular lifestyle products from Dyson and other leading brands. Redeem air miles at the dizzying rate of up to 4 miles per S$1 spend (4 mpd), or simply use them to offset your bills with 2.5% cashback.

Intrigued? Here’s a closer look at the HSBC Revolution Credit Card.

For more HSBC credit card options, check out our blog listing the best HSBC credit cards today.

Table of contents

Looking for the best credit cards to complement your spending patterns and expenditure in 2024? Check out our Ultimate Credit Card Guide that covers all things credit cards in Singapore – from choosing between a cashback, miles, or rewards credit card to planning your credit card strategy.

🎡 March Madness Promo 🎡

Sign up for participating products in our March Madness campaign and earn chances to spin the Madness Wheel and win up to 50% of your monthly salary and more! Valid till 31 March 2025. T&Cs apply.

HSBC Revolution Credit Card Overview

HSBC Revolution Credit Card product summary:

- 10X Rewards Points / 4 mpd for online purchases (including food deliveries, groceries, online shopping and travel

- [Update] Travel-related transactions will stop qualifying for 9X bonus Rewards Points after 31 Dec 202

- 1X Rewards Point / 0.4 mpd for all other spending

- No credit card annual fee

- Minimum income requirement: S$30,000 per year for Singaporeans/PRs, S$40,000 for self-employed, PR or foreigners

| Pros ✅ | Cons ❌ |

|

10X Rewards Points for online and contactless spending*, equivalent to 4 miles per dollar or 2.5% cashback |

10X Rewards Points do not apply to certain merchant category codes (MCCs) like: AXS and ATM transactions, top-ups to e-wallets and stored value cards, payments to insurance, educational institutions and payments, among others |

| No credit card annual fee | Bonus rate of 10X Rewards Points awarded on first S$1,000 spend per month only (1X Rewards Points rate awarded thereafter) |

| S$300,000 travel insurance cover for cardholder and family members | Rewards Points expire after 36 months |

| Free conversion until 31 Jan 2025; thereafter S$43.20 membership fee might apply | [Update] Contactless transactions will no longer earn bonus 9X rewards points from 15 Jul 2024. It will only earn the base 1X rewards points, or 0.4 mpd. |

| [Update] Travel-related transactions will no longe earn bonus 9X rewards points from 1 Jan 2025. It will only earn the base 1X rewards points, or 0.4 mpd. |

Benefits of the HSBC Revolution Credit Card

Great way for low spenders to generate air miles

The HSBC Revolution credit card gives you 10x rewards points per dollar spent, which is equivalent to 4 air miles per dollar. However, you can only earn 10x points on the first S$1,000 you spend each month (anything after only awards 1x point per dollar).

In other words, if you spend S$1,000 per month, you can earn 4,000 air miles each time. In contrast, with an air miles card that awards, say, 1.2 miles per dollar, you’ll need to spend over S$3,300 to earn 4,000 air miles.

Hence, if your monthly credit card spend doesn’t usually exceed S$1,000, yet you’re looking to collect air miles for your next trip, the HSBC Revolution credit card is the better way to do it.

Just remember to redeem your points for air miles before they expire in 36 months, and you’re golden.

Spend online to your heart's content [Update!]

Previously, the HSBC Revolution Card has been a reliable all-rounded miles credit card for many. However, since the back-to-back nerfs this year, it might be time to reconsider alternative miles cards.

Gone are the days when this card qualifies for a generous selection of bonus categories. Instead, from 15 July 2024 onwards, the HSBC Revolution Card will only be useful as an "online spend" credit card. This means that only eligible online transactions under the relevant merchant category codes (MCCs) are eligible for 10x rewards points per dollar spent, akin to how the Citi Rewards Card currently functions.

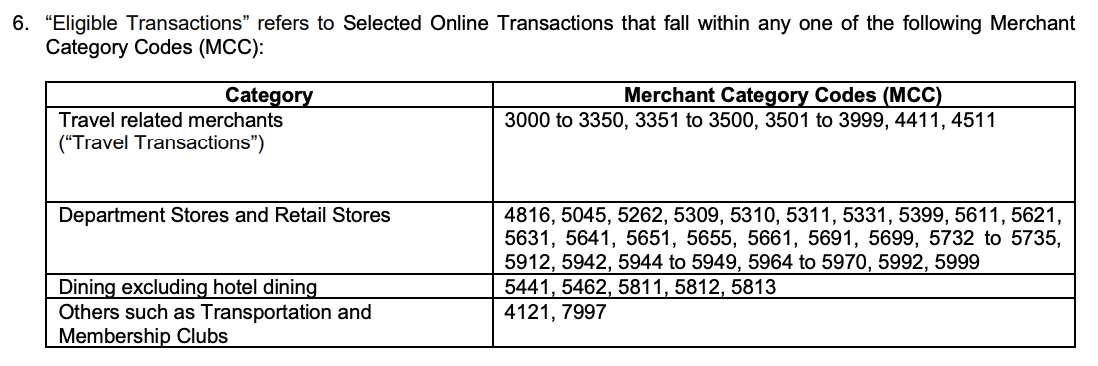

As of now, here are all the eligible MCCs:

MCCs 4722, 7011, 5411, 5499, and 5814 were removed earlier this year.

Do note, however, that the travel-related MCC transactions will only be eligible until 31 December 2024. But in general, most shopping, dining, and select transport expenses remain intact and are unfazed by the recent nerfs.

The only caveat is that they have to be online transactions to qualify for bonus rewards points. (More on this below.)

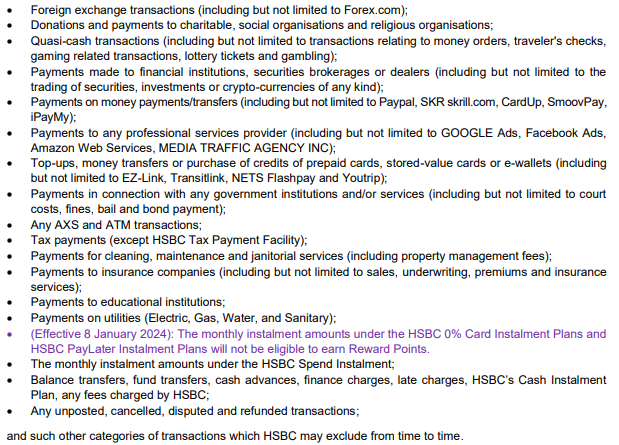

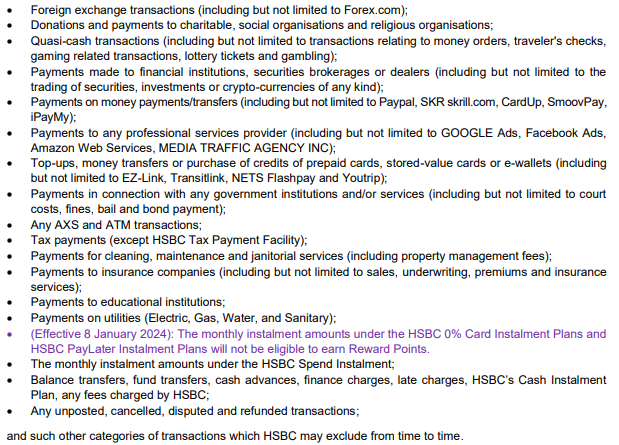

On the other hand, its list of non-qualifying MCCs comprises the usual excluded culprits like utilities, education fees, government institutions, tax payments, insurance premiums, store-reload top-ups, and more.

Source: HSBC

So if the HSBC Revolution Card has been your go-to miles credit card for most of your spending, it's time to re-consider other options like the UOB Lady's / Lady's Solitaire Card, KrisFlyer UOB Card (for Singapore Airlines and Scoot), or any other travel credit cards – all available here on SingSaver!

Multiple ways to use rewards points

There are three ways you can put your rewards points to work for you.

The first is to convert them into air miles, which you can redeem for free flights, upgrades and such. You can do so at a rate as high as 4 miles per dollar (see #1.)

Another way to derive value from your credit card spends is via HSBC’s Pay With Points programme. This allows you to use your rewards points to offset your bill, starting with 4,000 points for S$10, and 400 points for S$1 thereafter. This is equivalent to a cashback rate of 2.5%.

And the third option to use your rewards points is simply to redeem them for lifestyle rewards, including products, gadgets and vouchers - available on the HSBC Rewards Redemption page.

Complimentary travel insurance for cardmembers and family members

If you’re booking a trip with the HSBC Revolution credit card, you and your immediate family members will be entitled to complimentary travel insurance worth S$300,000.

This cover is automatically extended as long as you charge the full cost of the travel tickets for all eligible parties to your credit card.

The plan offers benefits for both personal accidents as well as flight inconvenience.

[Update] HSBC Revolution Card nerfs

Unfortunately, 2024 is a year stricken with nerfs for the HSBC Revolution Card. Here's a roundup of all the changes so far:

MCC removals

Since 1 January 2024, the HSBC Revolution Card no longer earns 10X Rewards on MCC 4722 (Travel Agencies & Tour Operators) and MCC 7011 (Lodging - Hotels, Motels, and Resorts).

|

❌ Removed bonus MCCs

(From 1 Jan 2024)

|

|

|

MCC 4722 (Travel Agencies & Tour Operators) ✈️🌍

|

MCC 7011 (Lodging - Hotels, Motels, and Resorts) 🏠

|

|

|

Notably, not all hotels will be affected by these changes in exclusions. Major hotel chains such as the Hilton (MCC 3504) and Hyatt (MCC 3604) have their unique MCCs falling in the 3500-3999 range. Thus, you'll need to conduct your own checks to verify which MCC your transactions at these hotels fall under.

Unfortunately, the nerfs don't just stop there. Three more MCCs have been removed from the list too: MCC 5411 (Supermarkets), MCC 5499 (Miscellaneous Food Stores), and MCC 5814 (Fast Food).

|

❌ Removed bonus MCCs

(From 1 May 2024)

|

||

|

MCC 5411 (Supermarkets) 🛒

|

MCC 5499 (Miscellaneous Food Stores)

|

MCC 5814 (Fast Food) 🍔

|

|

|

|

At least you can take heart that as long as your preferred F&B or supermarket merchant doesn't fall under the above categories, you can still earn 4 mpd on your transactions!

Meanwhile, its list of usual MCC exclusions like utilities, education fees, government institutions, tax payments, insurance premiums, store-reload top-ups, and more remain the same:

Source: HSBC

We want to say the nerfs stop there, but unfortunately... it doesn't.

No more bonus rewards for contactless spend

The biggest selling point of the HSBC Revolution Card was its 10X earn rate (4 mpd) on online and contactless transactions. However, it's since been announced that starting from 15 July 2024, contactless transactions will no longer qualify for this bonus rate.

That means, from 16 July 2024 onwards, the 10X earn rate will only apply to online transactions, while all contactless spending will revert to the base 1X earn rate.

This change is a shocker to many, as "tap and go" payments have become a fundamental part of our daily lives. But seems like all good things must come to an end, doesn't it? 😕

- Online spend: refers to payments transacted either in-app or on a website.

- Contactless spend: refers to in-person transactions paid either via tapping your physical card or paying with your mobile wallet.

No more bonus rewards for travel-related spend

In our opinion, this next one is another huge blow to the utility of the HSBC Revolution Card. Starting from 1 January 2025, travel-related transactions will no longer earn bonus rewards too. In fact, the whole "travel" category will be removed from its MCC bonus whitelist.

If you use your card primarily as your designated travel credit card, this is game-changing news (for the worse) because it'll be rendered ineffective in that regard. If you want to keep it within the HSBC family, the HSBC TravelOne Card is a decent choice considering it rewards 1.2 mpd on local spend and 2.4 mpd on foreign spend.

Once these nerfs fully take effect, how will the HSBC Revolution fare as an "online only" credit card?

[Update] How to continue maximising 10X rewards points on online transactions?

Although HSBC Revolution Card will continue to earn 10X rewards points on dining, shopping, and select transportation expenditure, these categories are further restricted by the card's "online spending" condition.

Meaning to say, you can only net 9X bonus rewards points on these categories if they're coded as online transactions. If you pay physically in person, it'll only earn the base 1X rewards points.

So far, as pointed out by MileLion, the only workarounds to circumvent this predicament would be:

- At restaurants or eateries where food is ordered and paid via QR code before serving

- At restaurants that are partnered with Kris+ or supports ShopBack Pay since the transaction will be coded as "online dining"

For the record, online food delivery services such as Deliveroo, GrabFood, and foodpanda tend to code as MCC 5814 (Fast Food) which was removed from HSBC Revolution's bonus whitelist back in May. However, not all hope is lost. There may be instances where food delivery is coded under MCC 5812 (Eating Places and Restaurants) – as demonstrated in this Deliveroo example on heymax.

So, what's the verdict? It's ultimately depends on your own discretion. If you think your online food delivery has a chance of being coded as MCC 5812 rather than 5814, then by all means, take the chance. 🤓

HSBC Rewards Points credited time

10X Reward Points earned from eligible transactions consist of two parts:

- Base 1X Points

- Bonus 9X Points

The base 1X points will be credited into your account based on your statement cycle. Meanwhile, the bonus 9X points will be credited into your account on the last day of the following calendar month from the posted transaction date. This will therefore be reflected in your statement by the last day of the second calendar month.

This is to say, suppose you:

Spent S$100 on dinner at Hai Di Lao on 5 November, you'll earn and be credited the base 1X points (100 Reward Points) in your next statement cycle whereas the bonus 10X points (1,000 Reward Points) will be credited and reflected by 31 December, latest.

💡Pro-tip: HSBC Rewards Points transfers are batched and processed on a weekly basis, translating to a waiting time of anywhere between 1 to 7 days.

How to calculate HSBC Rewards Points?

The best way to maximise your HSBC Revolution Credit Card is to reach the spend cap of S$1,000 each calendar month. By spending S$1,000, this is the point breakdown you stand to earn:

- 1X base points * S$1,000 = 1,000 Rewards Points

- 9X bonus points * S$1,000 = 9,000 Rewards Points

- Total points earned = 10,000 Rewards Points

When converted to miles, these 10,000 Rewards Points will equate to 4,000 miles in total.

Also do note that HSBC Rewards Points do not pool. Thus, you cannot combine points from other HSBC cards to convert them into miles.

But on the bright side, its miles conversion fee operates on a mileage programme membership basis. So as long as you pay the annual S$43.20 membership fee per year, you'll gain access to an unlimited number of point-to-miles conversion.

💡Pro-tip: For perspective, a one-way economy class ticket from Singapore to Kuala Lumpur costs 8,500 KrisFlyer miles to redeem. Therefore, the 4,000 miles earned through a month's spending already cover half the miles redemption needed for that ticket!

⭐️ Note: From now till 31 January 2025, mileage programme membership is free.

What charges or fees should you look out for?

- No annual fee

- Late payment fee: S$100

- Minimum monthly payment: S$50 or 100% of monthly instalment amount (if any) and 100% of any interest, late fees, annual credit card fees, and overlimit fees; 1% of remaining outstanding balance, plus excess amount above credit limit also applies

- Overlimit fee: S$40

- Cash advance fee: 8% of amount withdrawn, or S$15, whichever is greater

- Cash advance interest rate: 28% p.a.

- Interest on purchases: 27.8% p.a. compounded daily from date of transaction until full payment is made; minimum S$2.50 charge applies

- Foreign currency transaction fee: 3.25%

- Dynamic currency conversion (DCC) fee: 1%

- Annual mileage programme fee: Free until 31 Jan 2025 ⭐️

Eligibility criteria

- At least 21 years old

- Annual income requirement for Singaporeans/PRs: S$30,000

- Annual income requirement for Foreigners/Self-Employed: S$40,000

How to apply?

Click on the ‘Apply Now’ button on the HSBC Revolution product page and follow the on-screen instructions. You will need to prepare the following documents for the application process:

- Front and back of NRIC/Passport/Employment Pass/Proof of billing address

- Salaried employees: Past 12 months' CPF statement (Singaporean/PR), latest Income Tax Notice of Assessment via Myinfo, and latest 3 months' original computerised payslip

- Self-employed: Past 12 months' CPF statement and latest Income Tax Notice of Assessment

- Latest 1 year's Notice of Assessment only required if the above is not available

SingSaver x HSBC Revolution Credit Card Exclusive Offer

Enjoy rewards from Apple or Dyson, S$450 Cash, or 2x Poh Heng Treasures Gold Bar! Simply apply for an HSBC Revolution Credit Card via SingSaver and fulfil other promo criteria. Plus, earn chances to spin the Madness Wheel and win 50% of your monthly salary & more in our 🎡 March Madness Campaign 🎡 upon signing up! Valid till 31 March 2025. T&Cs apply.

Additionally, stand to win free trips to London, Tokyo or Bali, Samsonite Luggage, S$200 GrabGifts vouchers, cashback and other exciting prizes with HSBC's Sure-Win Spin. Simply transact with HSBC to start earning spins that guarantee a prize. T&Cs apply.

Is the HSBC Revolution Credit Card for you?

At this juncture, we'd recommend the HSBC Revolution Card more for avid online shoppers or those who frequently order food for home dining. Otherwise, this miles card may no longer meet the needs of some users, as its card offerings are now fairly weaker given the nerfs.

Otherwise, it remains as a viable option for those who value flexibility in their credit card rewards or earn up to 4 miles per dollar spend online – one of the highest miles earn rates available on the market.

Another point in this card's favour is the perpetually waived annual fee. This means that you to keep all of the rewards you earn from your spending, instead of having some of it clawed back to pay for the annual fee.

Alternative air miles credit cards you might be interested in

Think other air miles cards might be a better fit for you? Here are three alternative choices we think you might like.

HSBC TravelOne Card product summary

| Local spend | 1.2 miles per S$1 spend |

| Foreign spend | 2.4 miles per S$1 spend |

| Airport lounge access | 4 visits per year |

| Travel insurance | Up to US$100,000 coverage |

| Perks ⭐ | 5 free supplementary cards No conversion fee for miles or hotels points (until 31 Jan 2025) |

Citi Rewards Card product summary

|

Miles earn rate ✈️

|

10X Rewards Points / 4 mpd on:

0.4 mpd on all other spend

|

|

Bonus points cap

|

9,000 bonus points per month / S$1,000 spend per month

|

|

Base points cap

|

None

|

|

Travel insurance

|

Up to S$1 million coverage

|

|

⭐ 10X Rewards Points are rounded down to the nearest value

|

|

DBS Woman's/Woman's World Card product summary

|

DBS Woman's Card

|

DBS Woman's Wold Card

|

|

|

Miles earn rate ✈️

|

4 mpd on online spend

0.4 mpd on all other spend |

4 mpd on online spend

1.2 mpd on foreign spend 0.4 mpd on all other spend |

|

e-Commerce protection

|

Yes

|

Yes

|

|

Spend cap

|

S$1,000 online spend per month

|

S$2,000 online spend per month

|

|

Other perks ⭐️

|

Extra 5% cashback on overseas shopping and dining

|

|

Compare HSBC Revolution Card And Alternative Air Miles Credit Cards

about_the_author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.

HSBC Revolution Credit Card