Licensed Moneylenders vs Banks: Best Place to get Personal Loans in Singapore

Updated: 24 Sept 2025

Written bySingSaver Team

Team

The information on this page is for educational and informational purposes only and should not be considered financial or investment advice. While we review and compare financial products to help you find the best options, we do not provide personalised recommendations or investment advisory services. Always do your own research or consult a licensed financial professional before making any financial decisions.

Bank loans can be difficult to get if you have a poor credit history, but licensed moneylenders charge eye-wateringly high interest rates. Here’s what you need to know when deciding where to go for your personal loan.

Banks have long been the top choice for those in need of a personal loan, but licensed moneylenders, under the watchful eye of the Ministry of Law, have made great strides in pushing into the consumer credit sector.

Given the presence of such convincing competition, are banks still the best place to apply for a loan? The answer depends on who’s asking.

⚡SingSaver x Trust Personal Loan Flash Deal⚡

Enjoy low interest rates from 1.56% p.a. (EIR from 3.00% p.a.) plus up to S$1,750 in cashback and rewards when you sign up for Trust Bank Personal Loan via SingSaver. Plus, receive a S$10 FairPrice E-Voucher from Trust when you sign up with the referral code SINGSAVE. Valid till 1 January 2026. T&Cs apply.

For instant cash access

1. Download the Trust App and navigate to the Instant Loan section

2. Fill out an application and submit all required documents

3. Wait for approval of personal loan

- LOWEST Interest Rates in the Market from 1.56% p.a. (EIR 3.00%* p.a.) with no processing or hidden fees (until further notice)

- Flexible repayments. Choose your desired personal loan amount and tenure. Repay with fixed instalments over 3 to 60 months.

- Fast approval in 60 seconds.

- *EIR calculated based on loan amount of S$90,000 and tenure of 60 months from 1 Jan 2024. Maximum EIR may be up to 22.34% p.a. based on your personal credit profile.

- Deposit Insurance Scheme: SGD deposits of non-bank depositors are insured by the SDIC, for up to S$100,000 in aggregate per depositor per Scheme member by law.

- Min. age requirement: 21 years old

- Minimum annual income of S$30,000 for Singaporean citizen or PR or S$60,000 for foreigners with valid work pass

1. NRIC (Front & Back)

2. Salaried employees: Latest month’s computerised payslip or latest 6 months’ CPF contribution history statement

3. Self-employed individuals: Last 2 years’ Income Tax Notice of Assessment

4. Commission-based earners: Latest 3 months payslip or latest 6 months' CPF contribution history statement

The information displayed above is for reference only. The actual rates offered to you will be based on your credit score and is subject to the provider's approval.

SingSaver’s take

Trust Bank Instant Loan is perfect for borrowers who have good credit standing and need fast cash. With a low interest rate and flexibility to choose your repayment terms, it’s a great option if you are looking to split a big-ticket purchase into manageable chunks.

For existing UOB customers

1. Click “Apply Now” on UOB's website

2. Fill out the application and upload all necessary documents

3. Wait for an offer from UOB

Note: Get instant approval and cash disbursed into your UOB accounts for applications submitted between 8am and 9pm

- Enjoy interest rates as low as 1.52% p.a (EIR from 2.92% p.a.)

- No processing fees

- Get instant approval and cash disbursed into your UOB accounts for applications submitted between 8am and 9pm

- Min. loan amount of S$1,000

- Min. income for Singaporeans/PRs: S$30,000 p.a.

- Read our full review of the UOB Personal Loan

- Foreigners are not eligible for UOB Personal Loan

- Cancellation fee: S$150 or 3% of outstanding approved loan amount, whichever is higher

- NRIC (Front & Back)

- For salaried employees: Last 3 months’ computerised payslip; or Latest Income Tax Notice of Assessment with latest 1 month’s computerised payslip; or latest 6 months’ CPF statement (for Singaporeans or PRs)

- For self-employed persons: Last 2 years’ Income Tax Notice of Assessment

The information displayed above is for reference only. The actual rates offered to you will be based on your credit score and is subject to the provider’s approval.

SingSaver’s take

With a low minimum loan amount of $1,000, UOB Personal Loan is perfectly suited for locals who need to finance a modest purchase, such as a holiday. As the loan option is only available to existing UOB credit customers, borrowers can go through a simplified application process.

For digital users

1. Download the GXS app.

2. Click "Sign Up" for GXS FlexiLoan

3. Get your funds within minutes upon approval.

- No Fees Interest Rates from 1.88% p.a. (EIR from 3.47% p.a.). Promotional rate valid until 31 July 2025.

- Apply in-app and get your funds in minutes

- A standby revolving credit line which you can draw multiple loans from, from as low as S$200

- Customisable loan tenure from 2 to 60 months depending on loan amount selected

- Flexibility to select your preferred repayment date

- No early repayment fee, plus save on interest when you repay early

- Interest is computed on a daily non-compounding basis

- In-app reminders to repay on time and avoid late interest charges

- Effective Interest Rate (EIR) is calculated based on an average loan amount of S$10,000 with a 36-month repayment period, from 1 Jan 2023 to 1 Jan 2026. T&Cs apply.

- Late interest is chargeable upon late repayment

The information displayed above is for reference only. The actual rates offered to you will be based on your credit score and is subject to the provider's approval.

SingSaver’s take

Digital users looking for quick cash will love GXS FlexiLoan. Loans can be customised to the individual needs of borrowers and easily managed through the GXS App. The low minimum income requirement makes it an attractive choice to locals who require funds for a variety of purposes, such as home renovation.

Quick Comparison Table – Banks vs Licensed Moneylenders

|

Banks |

Licensed moneylenders |

|

|

Interest rate range |

2.49% to 5.54% p.a. |

Maximum of 4% per month, which can translate to 48% p.a. |

|

Regulation |

Regulated by Monetary Authority of Singapore (MAS) |

Regulated by the Registry of Moneylenders, Ministry of Law |

|

Loan amount |

Up to 12X of monthly income |

Up to 10X of monthly income |

|

Tenure |

Typically 1 to 2 years |

Up to 5 years |

|

Eligibility |

Minimum age requirement: 18 Main evaluation criteria: Debt-to-income ratio |

Minimum age requirement: 21 Main evaluation criteria: Credit history |

|

Approval time |

Fast – can be approved within 30 minutes |

Longer – requires time for documents and credit profile to be assessed and approved |

|

Fees |

Processing fee, early repayment penalty, late payment charges |

Processing fee, early repayment penalty, late payment charges |

|

Credit score requirement |

Not required, as long as borrower meets other eligibility criteria |

Good credit score from CBS (typically between 1911 and 2000) |

Quick Funds, Zero Hassle with SingSaver

If you’re stuck in a cash crunch, SingSaver makes it easy to find and compare emergency cash options in just minutes with a 70% approval rate—fast, simple, and hassle-free.

Interest rate

Let’s start with the elephant in the room: What’s the interest rate on personal loans by banks and licensed moneylenders?

No surprises here – banks offer a much lower interest rate on loans compared to licensed moneylenders.

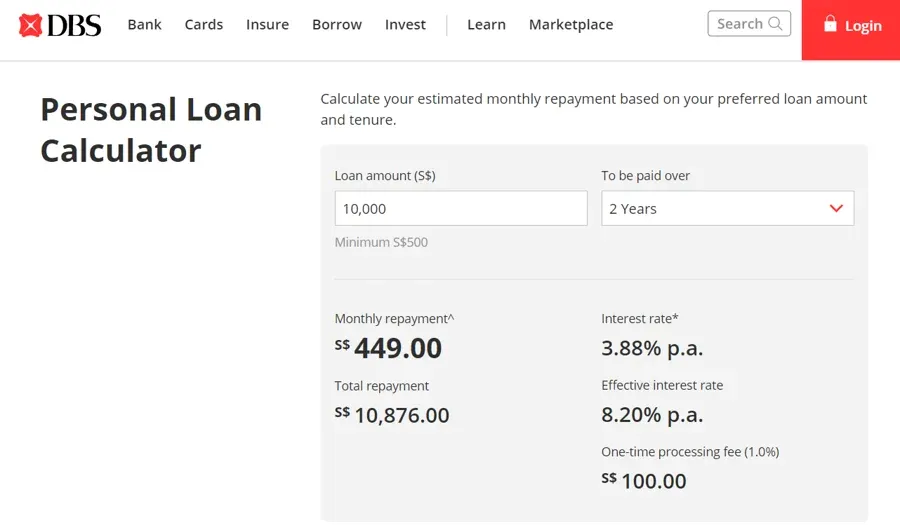

Using DBS as a benchmark, you can expect an interest rate of between 3.88% to 20.1% per annum + a 1% processing fee. The actual interest rate you’ll be offered depends on your income level (lower income equals higher interest rate), as well as your credit score (lower credit score tends to attract higher interest rates).

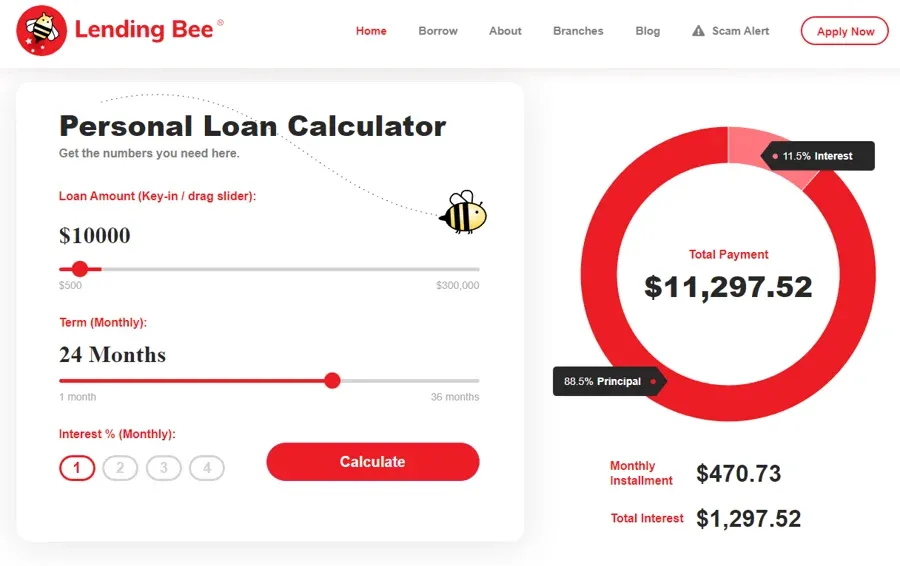

As for licensed moneylenders, the interest rate calculation is a little different. Under the law, licensed moneylenders are allowed to charge a maximum of 4% per month (and not per annum).

Now, this figure can be confusing to parse, not least because this interest rate is applied on a reducing balance basis. That’s to say, the 4% interest is calculated on the remaining loan amount each month.

Because of this, 4% per month doesn’t quite equate to 48% per annum. But, the interest on a licensed moneylender loan is still significantly higher than a bank personal loan, as shown in the following screenshots:

Taking a S$10,000 loan from DBS over 2 years will result in S$876 in total interest. However, the same loan at licensed moneylender Lending Bee – even at the lowest interest of 1% per month – will result in a higher total interest paid of S$1,297.52.

Just for fun, go ahead and pump up the interest rate on Lending Bee’s loan calculator to 4% monthly interest. We dare you.

SingSaver x HSBC Personal Loan Exclusive Offer

Enjoy attractive interest rates from 1.83% p.a. (EIR from 3.5% p.a.) plus get up to S$1,100 in Cashback when you apply for HSBC Personal Loan via SingSaver. Available to new and existing customers! Valid till 1 January 2026. T&Cs apply.

Regulation

After interest rates, the next big thing on borrowers’ minds is probably regulation. Are licensed moneylenders safe to borrow from?

To be fair, the licensed moneylending industry in Singapore has come a long way since its inception back in 2008. There’s even an organisational body, the Credit Association of Singapore, that aims to collectively advance the professional standards of moneylenders here through training and membership.

Just as banks and other financial institutions are regulated by the Monetary Authority of Singapore (MAS), licensed moneylenders are overseen by the Registry of Moneylenders, a division under the Ministry of Law.

However, that doesn't mean that there aren’t any bad apples around. Unlicensed moneylenders still prowl for victims, so be sure to familiarise yourself with what licensed moneylenders are and aren’t allowed to do if you are interested in their business, and always check the official list of licensed moneylenders before borrowing.

⚡SingSaver x UOB Personal Loan Flash Deal⚡

Get affordable interest rates from 1.52% p.a. (EIR from 2.92% p.a.) plus up to S$1,900 in cashback and rewards when you apply for a UOB Personal Loan via SingSaver. Valid till 1 January 2026. T&Cs apply.

Loan limit and tenure

Banks have a higher limit for personal loans.

Provided you meet the eligibility criteria, you may borrow up to 10x your monthly income from banks. Meanwhile, licensed moneylenders are only allowed to lend you a maximum of 6x of your monthly income.

Personal loans from banks are commonly 1 to 5 years in duration, which offers a higher degree of flexibility to borrowers. On the other hand, licensed moneylenders prefer to offer tenures of 12 months or less. They have a good reason for doing so, which we’ll discuss in the next section.

This is keeping in mind that a longer loan tenure translates to lower monthly instalment amounts. This makes it easier to borrow a larger amount. A loan with a shorter tenure means that the monthly repayments will be higher. This will limit how much you can borrow, as the monthly instalment amount may exceed your ability to pay.

Therefore, borrowers who are unable to make high repayments each month will likely find bank personal loans to be a more flexible option.

⚡SingSaver x SCB CashOne Personal Loan Flash Deal⚡

Experience the lowest interest rates from 1.80% p.a. (EIR from 3.44% p.a.) in the market, plus up to S$1,700 in Cashback when you apply for Standard Chartered CashOne Personal Loan via SingSaver. Valid till 1 January 2026. T&Cs apply.

Eligibility criteria

Certain borrowers may find it easier to acquire a loan from a licensed moneylender compared to a bank, and here’s why. In evaluating whether to grant your personal loan, one of the factors banks have to take into account is your credit score.

If you have a poor credit history – say, maybe you missed a few payments here and there or aren’t the most diligent in clearing your credit card balance – you will be deemed a risky borrower. Should your credit score fall below an acceptable threshold, your loan will be denied.

In contrast, licensed moneylenders aren’t too concerned with your credit history. Instead, they place greater emphasis on your ability to repay the loan. That’s to say, they focus on whether you have stable employment and, thus, presumably have the cash flow to make your monthly repayments.

Despite this, keep in mind that moneylenders don’t have your best interests at heart. By choosing to lend to risky borrowers, they can charge much higher interest rates to financially-strapped individuals who have no other choice. The trade-off is having to put up with a higher risk of borrowers not paying back their loans.

CIMB Personal Loan Welcome Offer

Enjoy low interest rates from 1.60% p.a. (EIR from 3.07% p.a.) when you apply for a CIMB Personal Loan! Valid till 1 January 2026. T&Cs apply.

Conclusion: Bank or licensed moneylender – which should you choose?

To sum up, banks are by far the better option if you need a personal loan. You’ll almost always be able to access better interest rates (which means less total interest paid) and choose a longer loan tenure for repayments. In addition, most banks have branches located all over Singapore, making it easy to interact with a bank of your choice.

In contrast, licensed moneylenders are independent operators, with a handful of branches at most, although the availability of online applications does make accessing moneylender loans just as convenient. Take note that you’ll still need to pay a visit to the moneylender’s physical location to sign the loan agreement.

For those who cannot qualify for a bank personal loan and urgently need cash to cope with an emergency, a licensed moneylender will be your only choice. Remember that licensed moneylenders charge interest on a reducing balance basis, so you should strive to pay your loan back as quickly as possible – doing so will reduce the total interest you have to pay.

Relevant articles

How to Get a Personal Loan in 7 Steps, A Singapore Guide

Thinking about taking out a personal loan? Understanding personal loans and how they work is key to making the right financial decision. It all starts with checking your credit, getting pre-qualified, and comparing loan options to find the best deal.

About the author

SingSaver Team

At SingSaver, we make personal finance accessible with easy to understand personal finance reads, tools and money hacks that simplify all of life’s financial decisions for you.