Confused about the endless number of “best savings accounts” (but hey ours is pretty useful) out there? Here’s the one guide you need if you’re looking to maximise your savings without jumping through too many hoops.

It’s no secret that everyone wants to maximise cashback or interest with their credit card and savings account. But just like how girls change their men clothes all the time depending on the seasons, banks are no different. According to market conditions, interest rates are always changing.

You may have found your holy grail savings account for now, but that doesn’t mean the interest is going to remain constant five months down the road.

During the peak of the pandemic, many savings accounts slashed their interest rates. For example, back when jumpstart was offering a whopping base interest of 2% p.a., everyone rushed to sign up for it. But after a few months, COVID-19 took a hit on the economy, and their base interest took a plunge. The same goes for credit cards. The Instrarem Amaze Card promised 1% cashback on all spending at first but has recently removed its cashback altogether and replaced it with their new InstaPoints system.

With all that noise going on, how do you find the ultimate combo? Look no further — I have done my due research and can present to you the ultimate pairings for a savings account and a credit card to maximise rewards. But who’s to say it won’t change again?

Table of contents

- Best credit card and savings account combinations

- UOB One Account + UOB One Card

- CIMB FastSaver + CIMB Visa Signature

- DBS Multiplier + DBS Live Fresh

- OCBC 360 Account + OCBC 365 Credit Card

- StanChart Bonus$aver + Bonus$aver World Mastercard

More on this topic:

Best Savings Accounts In Singapore To Stash Your Cash

Best Savings Accounts in Singapore (2023)

Best Alternatives To Savings Accounts In Singapore (2023)

Best Savings Accounts & CDAs for Kids in Singapore 2023

14 Best Fixed Deposit Rates in Singapore to Lock in Your Savings

Best credit card and savings account combinations

This is based on Joe’s profile. He credits his salary of S$4,000 to the savings account, spends S$800 on his credit card monthly and has a bank balance of S$20,000.

|

Credit card + savings account

|

Realistic savings account interest

|

Estimated annual interest earned

|

Realistic cashback interest

|

Estimated annual cashback earned

|

Total annual earnings

|

|

3.85% p.a.

|

S$770

|

Up to 10%

|

S$452

|

S$1,222

|

|

|

CIMB FastSaver + CIMB Visa Signature

|

2.20% p.a. for first S$10,000 & 1.50% p.a. for next S$15,000

|

S$445

|

10%

|

S$724.80

|

S$1,169.80

|

|

2.60% p.a.

|

S$520

|

Up to 6%

|

S$379.80

|

S$899.80

|

|

|

StanChart Bonus$aver + Bonus$aver World Mastercard

|

3.80% p.a.

|

S$760

|

N/A

|

N/A

|

S$760

|

|

1.50% p.a.

|

S$300

|

6%

|

S$423.60

|

S$723.60

|

More on this topic:

Standard Chartered Unlimited Credit Card Review

UOB One Card Review: Generous Everyday Cashback Card

POSB Everyday Card Review: Reliable, All-Rounded Cashback Card

Citi Cash Back+ Mastercard Review

#1: UOB One Account + UOB One Card — 3.85% p.a. + up to 10% cashback

UOB One Account

The UOB One Account has once again revised its rates and emerges first place as the savings account that offers the highest realistic interest rate.

By earning interest on your savings, spending on your credit card and crediting your salary of more than S$3,000, you’re essentially earning the highest interest tier possible. To earn the highest interest of 7.8%, you’ll need funds above S$75,000 to S$100,000.

Based on Joe’s financial circumstances, he earns a total of S$770 annual interest.

Based on Joe’s financial circumstances, he earns a total of S$770 annual interest.

UOB One Card

UOB One Credit Card Welcome Gift: Get S$350 cash credit when you are one of the first 200 applicants to successfully apply for the UOB One Credit Card and spend a min. of S$1,000 per month for 2 consecutive months from card approval date. Valid till 30 April 2025. T&Cs apply.

With the UOB One Card, you’ll get up to 10% cashback on bus and train rides with SimplyGo, and 10% cash rebates on Grab rides and food (excluding Grab mobile wallet top-ups).

You’ll also earn 10% rebates at certain grocery stores and beauty and wellness retail outlets under Dairy Farm International such as Cold Storage, Giant, Guardian, 7-Eleven, Marketplace, Jasons, Jasons Deli, as well as online spend on Shopee.

If you’re running on Singapore Power, you’ll get a 4.33% cashback on their utility bills, as well as 3.33% cashback on other spend including dining, overseas spend and supplementary card spend.

Using a rough estimate based on a spending of S$800 per month in these categories, Joe may earn an estimated annual cashback/rebate of S$452 based on these spendings:

- S$200 on transport (including Grab)

- S$200 on groceries, beauty and wellness

- S$100 on dining

- S$100 on utilities bills

- S$100 on recurring bill payment

- S$100 on other spend

He’ll just have to hit a minimum spend of S$500 and make at least 5 card transactions for the quarter. You can also head over to their UOB One Credit Card rebate calculator for a more accurate estimated rebate you can receive based on your spending habits.

The only drawback of the UOB One Card is that the mechanics can be slightly complicated, and the cashback is only given to you in quarters.

UOB One Credit Card Welcome Gift: Get S$350 cash credit when you are one of the first 200 applicants to successfully apply for the UOB One Credit Card and spend a min. of S$1,000 per month for 2 consecutive months from card approval date. Valid till 30 April 2025. T&Cs apply.

#2: CIMB FastSaver Account + CIMB Visa Signature Card — up to 2.20% p.a. + up to 10% cashback

CIMB FastSaver Account

As of 1 November 2022, CIMB FastSaver Account revised their rates and interest eligibilities. It has now reverted back to interest earned based on your account balance, monthly spend and investment/insurance purchase.

If you’re just like Joe, who has S$20,000 in your account, you can earn an interest of 2.20% p.a. on your first S$10,000. For the next S$15,000, you will earn an interest of 1.5% p.a. Since it has revised the system, the interest rate that Joe has increased.

CIMB Visa Signature Card

SingSaver Exclusive Offer: Enjoy the following rewards when you sign up for a CIMB Visa Signature Credit Card. Eligible for CIMB new cardholders only.

Receive S$50 Cash via PayNow when you apply and spend a min. of S$108 within 30 days of card approval. Offer is stackable with ongoing S$188 Cashback CIMB Welcome Offer. Valid until 30 April 2025. T&Cs apply.

Out of all the CIMB cards in the market, The CIMB Visa Signature Card is the one that stands out as it offers a 10% cashback on online shopping, groceries, beauty/wellness etc — one of the highest cashback rates out there. Its minimum spending is also fairly reasonable compared to other CIMB cards that require a minimum spending of S$1,000 for just 1% cashback.

The minimum spend is S$800 per month if you want to be eligible for the 10% cashback. There is also a cashback cap of S$100 per statement month and up to S$20 per category. When you exceed the cashback cap, you’ll only earn 0.2% cashback on all spending.

With a rough breakdown of spendings with an S$800 minimum spending, let’s assume:

- S$300 on online shopping — S$20 (cap reached) + S$0.20

- S$300 on groceries — S$20 (cap reached) + $0.20

- S$200 on beauty and wellness, pet shops and veterinary services, cruises — S$20

Joe will be able to earn a monthly cashback of S$60.40, which means an annual interest of S$724.80.

#3: OCBC 360 Account + OCBC 365 Credit Card — 2.60% p.a. + up to 6% cashback

OCBC 360 account

Good news folks! OCBC 360 account once again revised their interest rates, successfully clinching second place.

Using Joe’s financial profile, he would be able to earn an interest rate of 2.60% p.a., which amounts to a decent S$520 in annual interest. Here’s how:

If he wants to earn extra bonus interest, he’ll either need to save, insure, invest or grow his account by maintaining an average daily balance of S$200,000 and above.

If he wants to earn extra bonus interest, he’ll either need to save, insure, invest or grow his account by maintaining an average daily balance of S$200,000 and above.

OCBC 365 Credit Card

The only card that can be paired with the OCBC 360 Account is the OCBC 365 credit card which offers rather competitive cashback rates.

The only card that can be paired with the OCBC 360 Account is the OCBC 365 credit card which offers rather competitive cashback rates.

You’ll earn 6% on local and overseas dining and food delivery, 4% on local and overseas groceries and online groceries, 3% on local and overseas taxi rides and private hire rides, 5% on petrol, 3% on utilities and 3% on online travel. Other expenses entitle you to a 0.3% cashback.

However, to earn all these attractive cashback rates, you’ll also need to spend S$800 a month. Anything less will entitle you to a flat rate of 0.3% cashback. The cashback amount is also capped at S$80 per month, regardless of category.

Assuming you spend:

- S$200 on dining — S$12

- S$200 on groceries — S$6

- S$100 on transport — S$3

- S$150 on petrol — S$7.50

- S$100 on utilities — S$3

- S$50 on other spend — S$0.15

That adds up to a monthly cashback of S$31.65, and an annual cashback of S$379.80.

SingSaver's Exclusive Offer: Receive the following rewards when you apply for select OCBC credit cards:

Get an Apple AirPods 4 (worth S$199), S$170 Shopee Voucher, S$150 Cash, or a Stryv Colour+ (worth S$129) when you apply and make at least one (1) transaction of any amount within 30 days of card approval. Applicable to new OCBC credit card holders only. Valid till 1 May 2025. T&Cs apply.

SingSaver's Exclusive Offer: Receive the following rewards when you apply for an OCBC 365 Card:

Get an Apple AirPods 4 (worth S$199), S$170 Shopee Voucher, S$150 Cash, or a Stryv Colour+ (worth S$129) when you apply and make at least one (1) transaction of any amount within 30 days of card approval. Applicable to new OCBC credit card holders only. Valid till 1 May 2025. T&Cs apply.

#4: StanChart Bonus$aver + Bonus$aver World Mastercard — 3.80% p.a.

StanChart Bonus$aver

Recently, Standard Chartered announced that they would be increasing their interest rate up to a whopping 7.88% p.a. On your first S$100,000 deposit. This is by far the highest interest rate offered by any banks for savings accounts.

But just how easily attainable is the 7.88%? Because let’s face it, not many are willing to buy new insurance and investment products just to qualify for bonus interest. With so many hoops to jump through, the average person would probably be willing to just qualify for credit card spend and salary credit.

According to Joe’s S$20,000 savings, S$800 credit card spend and S$4,000 salary credit, let’s see how much interest he can earn:

He can easily earn an interest of 3.80% p.a. If he makes at least three bill payments of at least S$50 each, he can easily earn the extra 0.33% bonus interest. Moreover, spending more than S$2,000 will also grant you an extra 0.75% interest.

Joe can earn S$760 in annual interest.

Bonus$aver World Mastercard Credit/Debit

Unlike other banks that allow you to use any credit cards offered by their bank, the Bonus$aver account only recognises transactions made on your Bonus$aver World Mastercard. Because of this, you won’t be able to earn extra cashback on your credit card as the card doesn’t offer any cashback benefits.

The only silver lining is that they offer attractive petrol station benefits. You can enjoy 16.5% savings for Caltex Platinum 98 fuel (16% on site + 0.5% LinkPoints) and up to 16.6% savings for other Caltex fuel (16% on CaltexGO App + 0.6% LinkPoints).

#5: DBS Multiplier + DBS Live Fresh — 0.90% p.a. + 5% cashback

DBS Multiplier

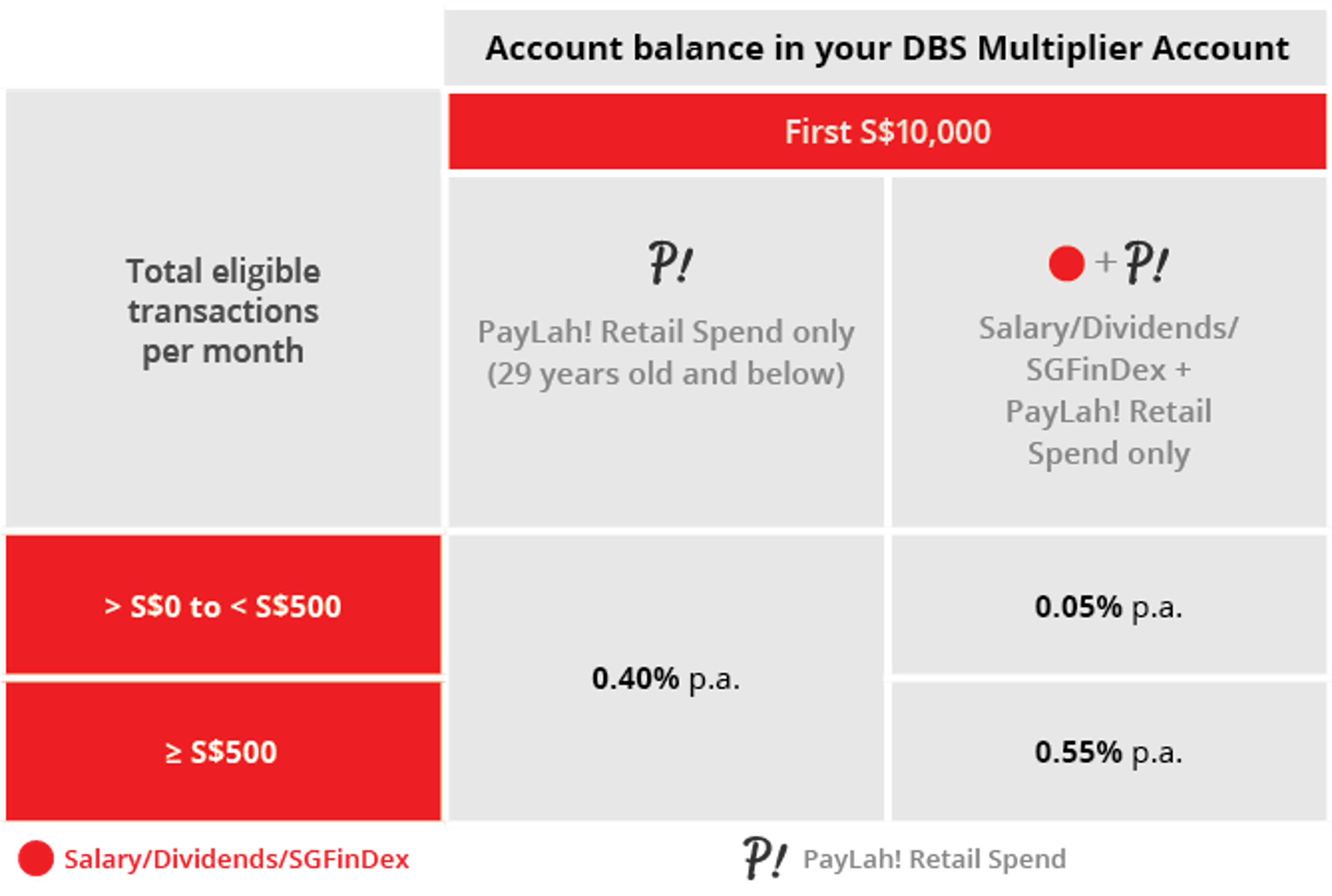

Hopping on the bandwagon, DBS Multiplier also recently announced an increase in the highest interest rate offered from 3.5% p.a. to 4.1% p.a. But realistically speaking, Joe can earn an interest rate of 1.50% p.a.

All he has to do is to credit his salary and transact in at least one category — credit card spending. DBS Multiplier calculates the total eligible transactions per month, which includes salary credit. So based on Joe’s case, if he earns a salary of S$4,000 and spends S$800 on his credit card, the total eligible transaction will be S$4,800, earning him an interest of 1.50% p.a. That is S$300 interest per year,

If Joe wants to earn more interest, he either has to spend at least S$1,000 on his credit card, earn a higher income of S$4,200 or transact in another category — interest, investment or home loan.

There is an alternative to earn interest, which is to rely on PayLah! transactions. However, you have to be 29 years old and below, and the highest interest earned is significantly lesser.

DBS Live Fresh Card

Out of all the eligible DBS cards that can be paired with DBS Multiplier, DBS Live Fresh stands out because of its greater range of eligible spending to qualify for cashback.

Right off the bat, DBS Live Fresh lets you earn 6% cashback on online and in-store shopping spend, which basically encompasses anything you purchase online, without limiting to specific retail outlets or merchants.

This card also rewards you with 6% cashback on transport spend. All other spending will earn you a 0.3% unlimited base cashback rate.

The only catch is that you’ll have to spend a minimum of S$800 each month. There is also a cashback cap of S$50 on shopping spend and S$20 on eligible transport spend. No cashback cap is set for all other eligible spend.

Doing a rough gauge on an S$800 budget, it’s quite possible to earn S$36.60 per month, giving you a total of S$439.20 for annual cashback:

- S$300 on shopping spend — S$18

- S$300 on transport spend (including SimplyGo) — S$18

- S$200 other spend — S$0.60

SingSaver Exclusive Offer: Get a Nintendo Switch OLED (worth S$549), Apple iPad 9th 10.2" WiFi 64GB (worth S$479), Apple AirPods Pro (Gen 2) With Magsafe Charging Case + MagSafe Charger (worth S$408), or S$350 eCapitaVoucher when you apply for select DBS Credit Cards via SingSaver and hit a min spend of S$500 within 30 days of card approval. Valid till 30 April 2025. T&Cs apply.

More on this topic:

UOB One Savings Account Review 2023

CIMB FastSaver Account Review (2023)

Standard Chartered Bonus$aver Account Review (2023)

DBS Multiplier: Most Pandemic-proof Savings Account

Best Cashback Credit Cards (with min. spending and cap)

| Credit Card | Best for/Benefits | Details | Min. Annual Income |

|

Citi Cash Back Card

|

- 8% cashback on Petrol and Private Commute

- 6% cashback on Groceries and Dining

- 0.20% cashback on all other spending

|

- Min. S$800 monthly spend

- S$80 cashback cap (per statement month) - Annual fee: S$196.20 (First year free; 9% GST w.e.f. 1 Jan 2024) |

- Local/PR: S$30,000

- Foreigner: S$42,000

|

|

CIMB Visa Signature Card

|

- 10% cashback on Online Shopping, Groceries, Beauty & Wellness, Pet Shops & Vet services, and Cruises

- Unlimited 0.2% cashback for all other spending

|

- Min. S$800 monthly spend

- S$100 cashback cap (per statement month), and up to S$20 per category

- For spend beyond the cap, you will earn 0.2% cashback

- No annual fee

|

- Local/PR: S$30,000

|

|

Maybank Family & Friends Card

|

- 8% cashback on 5 selected categories:

1) Groceries 2) Dining & Food Delivery 3) Transport, Data Communication & Online TV Streaming 4) Retail & Pets 5) Online Fashion 6) Entertainment 7) Pharmacy 8) Sports & Sports 9) Apparels 10) Beauty & Wellness - 0.25% cashback on all other spending |

- Min. S$800 monthly spend

- S$125 cashback cap (per statement month), and up to S$25 per category

- Annual fee: S$181.67 (First 3 years free; 9% GST w.e.f. 1 Jan 2024)

|

- Local/PR: S$30,000

- Malaysian Citizen: S$45,000

- Foreigner: S$60,000

|

|

UOB EVOL Card

|

- 10% cashback on Online Spend

- 10% cashback on Mobile Contactless Spend

- 10% cashback on overseas in-store foreign currency spend

- 0.3% cashback on all other spending

|

- Min. S$800 monthly spend

- S$80 total cashback cap (per statement month)

- Annual fee: S$196.20 (Waived when you make a min. 3 transactions every month for 12 consecutive months)

|

- Local/PR: S$30,000

- Foreigner: S$40,000

|

|

OCBC 365 Card

|

- 5% cashback on Dining and Online Food Delivery

- 6% cashback on Petrol

- 3% cashback on Groceries, Land Transport, Utilities, Streaming, Drugstore and Electric Vehicle Charging

- 0.25% cashback on all other spending

|

- Min. S$800 & S$1,600 monthly spend

- S$80 & S$160 cashback cap depending on monthly spend tier (per statement month)

- Annual fee: S$196.20 (First 2 years free; 9% GST w.e.f. 1 Jan 2024)

|

- Local/PR: S$30,000

- Foreigner: S$45,000

|

Similar articles

Best Credit Cards To Power Up Interest Rate On Your Savings Account (2020)

Citi Plus Review: All-In-One Wealth Management Platform + Savings Account

Best Savings Accounts In Singapore To Park Your Money (2024)

HSBC Advance Review: The Bank Account That Grows With You

CIMB StarSaver Account Review: Great For Large Balances

CIMB FastSaver Account Review (2024): Features, Minimum Balance & More

Another One Bites The Dust: Major Savings Accounts Further Slash Interest Rates For 2021

Credit Card Comparison: DBS Live Fresh vs UOB EVOL vs OCBC FRANK

.png?width=800&height=253&name=DBS-CC_Mar-30Apr_INBLOGBANNER_KV1_800x250%20(1).png)