Every spending situation is unique. SingSaver assembles the 'Best For' list, so you can decide what’s best for you.

Like many things in Singapore, weddings are a costly affair. Thankfully, with the right credit cards, you can (hopefully) save some money on your wedding expenses and banquet.

Best Credit Cards To Use For Wedding Expenses On SingSaver

Unlimited Cashback With AMEX benefits: AMEX True Cashback Card

Best For Generous Cashback: CIMB Visa Signature Card

Best For Exclusive Travel Memberships: AMEX Singapore Airlines KrisFlyer Ascend Credit Card

Best For Luxury Perks: Citi Prestige Card

Best For Affordable Miles & Perks: DBS Altitude Card

Best For Highest Unlimited Cashback: UOB Absolute Cashback Card

Not going to lie, weddings in Singapore are expensive affairs. As an avid credit card rewards chaser who’s almost done with all the necessary planning for the Big Day next week, I suppose you can trust my picks for the best credit cards for wedding expenses.

When I mean wedding expenses, it includes venue/ banquet booking, gown and suit rental, photography and videography services, makeup and hair services, pre-wedding shoot, wedding stationery and decor, flowers, wedding favours and more. Sadly, these things don’t come cheap.

Make each hard-earned dollar of yours go further whenever possible by paying with credit cards. However, do note that not all wedding vendors accept credit card payments.

Without further ado, here are my picks to help you be extra savvy with your money for your big day:

- Best For Unlimited Cashback With AMEX Benefits: American Express True Cashback Credit Card

- Best For Generous 10% Cashback: CIMB Visa Signature Credit Card

- Best For Exclusive Travel Memberships: American Express Singapore Airlines KrisFlyer Ascend Credit Card

- Best For Luxury Perks: Citi Prestige Credit Card

- Best For Affordable Miles & Perks: DBS Altitude Credit Card

- Best For Highest Unlimited Flat Cashback: UOB Absolute Cashback Credit Card

Best For Unlimited Cashback With AMEX Benefits: American Express True Cashback Credit Card

American Express True Cashback Card is one of our top picks for wedding expenses because you can earn unlimited 1.5% cashback on all eligible spending, with no minimum spend required. What’s even sweeter? You get double the cashback at 3% on the first S$5,000 spent within the first six months.

That’s not all. American Express True Cashback Card Members can look forward to True Love Weddings, a generous 5% discount off new wedding packages at selected wedding venues, exclusively reserved for them. This discount is on top of all the cashback you can potentially earn.

SingSaver's Exclusive Offer: Receive the following rewards when you sign up for an Amex True Cashback Card:

Receive S$100 via PayNow, S$120 Shopee Vouchers, or Apple AirTag (4 pack) (worth S$149) when you apply and make a min. spend of S$500 within first month of Card approval. Available to new-to-American-Express card members only. Valid until 20 April 2025. T&Cs apply.

Best For Generous 10% Cashback: CIMB Visa Signature Credit Card

In our opinion, the CIMB Visa Signature Card is a heavily underrated cashback card for wedding expenses – more specifically, for "wedding investments" on yourself. As long as you satisfy a minimum S$800 spend every calendar month, you'll be entitled to 10% cashback on all eligible online shopping purchases and beauty & wellness transactions, capped at a total of S$125 monthly cashback (or S$25 per category).

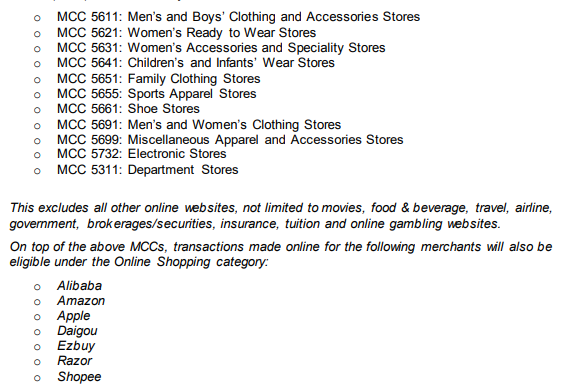

All hopeful bride-to-bes will appreciate the generous eligibility offered under these categories; for instance, all online shopping purchases under the following merchant category codes (MCCs) qualify for the 10% cashback:

Source: CIMB

Source: CIMB

This even extends to popular platforms like Amazon, Ezbuy, and Shopee! So all your online bridal affairs and needs can be pretty much settled on these e-commerce sites. Whether it's your shoes, gown rental, accessories, or other wedding peripherals, the 10% cashback will be yours to keep as long as they fall under the valid MCCs regardless of local or overseas transactions.

Other than that, you also can't go wrong with pampering yourself with facials and massages leading up to your big day. All local or international transactions made at personal care facilities, pharmacies, cosmetic stores (excluding department stores), hairdressers, massage parlours, and health & beauty spas will qualify for the 10% cashback. So if you want to fly overseas for the ultimate spa retreat with your partner or your friends and family, who's to stop you? 😄

SingSaver Exclusive Offer: Enjoy the following rewards when you sign up for a CIMB Visa Signature Credit Card. Eligible for CIMB new cardholders only.

Receive S$50 Cash via PayNow when you apply and spend a min. of S$108 within 30 days of card approval. Offer is stackable with ongoing S$188 Cashback CIMB Welcome Offer. Valid until 30 April 2025. T&Cs apply.

Other honourable cashback card mentions include the UOB One Card, Maybank Family & Friends Card, OCBC Frank Card, and the UOB EVOL Card.

UOB One Card product summary:

|

Cashback rate

|

Up to 10% cashback (Existing UOB customers)

Up to 15% cashback (New-to-UOB customers)

|

|

Eligible spend categories

|

SimplyGo, Shopee, Dairy Farm International, Grab, UOB Travel, SPC, Shell

|

|

Minimum spend requirement

|

S$500, S$1,000, or S$2,000 monthly for 3 consecutive months

Min. 5 transactions per statement month

|

|

Cashback cap

|

S$50, S$100, or S$200 per quarter

|

|

⭐ Great for multiple big-ticket expenses for consecutive months

|

|

Maybank Family & Friends Card product summary:

|

Cashback rate

|

8% cashback on five preferred categories:

8% cashback on Malaysian Ringgit too

|

|

Minimum spend requirement

|

S$800 per calendar month

|

|

Cashback cap

|

S$125 total per calendar month, S$25 per category

|

|

⭐ Three-year annual fee waiver

|

|

-2.png?width=250&height=155&name=OCBC-FRANK-Platinum-U1200476-Front(RGB)-2.png)

OCBC Frank Card product summary:

|

Cashback rate

|

8% cashback on foreign currency spend, online, and mobile contactless spend

Extra 2% cashback on selected eco-friendly merchants

|

|

Minimum spend requirement

|

S$800 per calendar month

|

|

Cashback cap

|

S$100 total per calendar month, S$25 per category

|

UOB EVOL Card product summary:

|

Cashback rate

|

8% cashback on online and mobile contactless spend

|

|

Minimum spend requirement

|

S$600 per statement month

|

|

Cashback cap

|

S$60 total per statement month, S$20 per category

|

|

⭐ No annual fee with min. 3 purchases monthly

|

|

Best For Exclusive Travel Memberships: American Express Singapore Airlines KrisFlyer Ascend Credit Card

The American Express Singapore Airlines KrisFlyer Ascend Credit Card is ideal for the discerning traveller who enjoys the finer things in life.

This credit card lets you enjoy a complimentary Hilton Honors Silver membership tier (hello, one free night stay at Hilton properties in APAC each year). You will also enjoy an accelerated upgrade to the KrisFlyer Elite Gold membership tier and four complimentary annual airport lounge access passes.

Of course, you can earn unlimited, convenient KrisFlyer miles on your expenses with this credit card:

- 1.2 KrisFlyer miles for every S$1 spent on all eligible purchases

- 2 KrisFlyer miles for every S$1 equivalent in foreign currency spent overseas on eligible purchases during June and December

- 2 KrisFlyer miles per S$1 spent on singaporeair.com, SingaporeAir mobile app, silkair.com and KrisShop

- 3.2 KrisFlyer miles for every S$1 spent on Grab Singapore transactions, up to S$200 spent each calendar month

- 0.5 KrisFlyer mile per S$1 spent on Singapore Airlines Instalment Plans

If you’re new to American Express and have big-ticket wedding expenses to pay for, consider signing up for this credit card to snag the sweet sign-up spend bonus, which would make a delightful surprise for your soon-to-be spouse!

Amex Singapore Airlines KrisFlyer Ascend Credit Card Welcome Gift:

For New-to-American Express Card Members: Receive up to 40,000 KrisFlyer miles (enough to redeem a return trip to Taipei on Singapore Airlines) with annual fee payment and min. spending of S$2,000 within the first three months of Card approval. Valid till 28 May 2025. T&Cs apply.

For Existing American Express Card Members: Receive up to 30,000 KrisFlyer miles with annual fee payment and min. spending of S$2,000 within the first three months of Card approval. Valid till 28 May 2025. T&Cs apply

See also: American Express Singapore Airlines KrisFlyer Ascend Credit Card Review

#4: Best For Luxury Perks: Citi Prestige Credit Card

Are you and your soon-to-be betrothed avid travellers? If so, you will appreciate all that Citi Prestige Credit Card has to offer.

Apart from the status symbol associated with holding this credit card, you will enjoy unlimited, expiry-free rewards points on every purchase you make.

There is no limit to the number of times you can use the complimentary night stay benefit with a minimum consecutive four-night stay at any hotel or resort around the world — simply make your reservations through the Citi Prestige Concierge.

That’s not all. You’d also have access to World Elite luxury vacations, private and bespoke travel experiences, discounted luxury cruises, private jet and chauffeured car services. Plus, you and your other half can visit Priority Pass airport lounges globally however many times you want, at no extra cost.

Additionally, you can look forward to earning up to 30% additional ThankYou Points — think of this as Citi’s way of rewarding their loyal customers.

🎤SingSaver Concert Tickets Giveaway🎤: Get a chance to win a pair of VIP Suite Concert tickets of a Grammy-winning Singer on top of existing SingSaver Exclusive Offers when you apply for select credit cards! Valid till 4 May 2025. T&Cs apply.

📣ONLY AVAILABLE ON SINGSAVER📣: Enjoy the following rewards when you sign up for a Citi Prestige Card.

Receive rewards such as 2x Treasures Poh Heng 1gm Gold Bar in Yellow Gold (999), upsized S$450 Cash, a DJI Osmo Action 5 Pro Standard Combo (worth S$489), a Dyson V12 Origin (worth S$749), a Dyson Supersonic (worth S$649), or an Apple iPad (A16) 11" Wi-Fi 128GB (worth S$499.00) upon activating and spending a minimum of S$500 within 30 days of card approval. This card offer is exclusively available on SingSaver. Valid until 20 April 2025. T&Cs apply.

🚀Fastest Rewards Fulfilment🚀: Get the cash rewards within four (4) weeks after successful application — the fastest rewards fulfilment yet! T&Cs apply.

⬆️Reward Upgrade Campaign⬆️: Upgrade your reward to an Apple iPhone 16 Pro 256GB (worth S$1,1,749.00) when you top S$1,200. Valid until 1 May 2025. T&Cs apply.

Best For Affordable Miles & Perks: DBS Altitude Credit Card

DBS Altitude Credit Card is a solid choice if you’d like to chase miles on the cheap and enjoy travel perks like complimentary travel accident insurance coverage of up to S$1 million and two free Priority Pass lounge visits in a 12-month membership period.

This miles credit card lets you earn unlimited 1.3 miles per S$1 spent locally and 2.2 miles per S$1 spent in foreign currency. You can also earn up to 3 miles per S$1 spent on Agoda bookings — perfect for when you’re planning the honeymoon trip of your dreams!

Apart from chalking up miles on your wedding expenses, you can snag 10,000 bonus miles simply by paying the annual fee.

Feel like splitting your wedding bills into more manageable amounts? You can do so easily via My Preferred Payment Plan and enjoy 0% interest instalments for up to six months. This should be music to your ears, agree?

SingSaver Exclusive Offer: Get a Nintendo Switch OLED (worth S$549), Apple iPad 9th 10.2" WiFi 64GB (worth S$479), Apple AirPods Pro (Gen 2) With Magsafe Charging Case + MagSafe Charger (worth S$408), or S$350 eCapitaVoucher when you apply for a DBS Altitude Credit Card via SingSaver and hit a min spend of S$500 within 30 days of card approval. Valid till 30 April 2025. T&Cs apply.

Best For Highest Unlimited Flat Cashback: UOB Absolute Cashback Credit Card

On the hunt for a fuss-free cashback credit card that’s rewarding altogether? Look no further than the UOB Absolute Cashback Card.

No minimum spend, no cashback cap, and no spend exclusions — you can earn a flat 1.7% cashback on literally everything you purchase with this credit card.

At the time of writing, the UOB Absolute Cashback Card offers the highest unlimited flat cashback rate amongst the competition. Most credit cards of this nature offer 1.5% to 1.6% cashback.

While 1.7% cashback may not sound like much, it can mean a whole world of difference when you consider the many large expenditures you’ll be splashing out for your wedding.

Examples include venue booking, hair and makeup services, gown and suit rental services, photography and videography services, and much more.

UOB Absolute Credit Card Welcome Gift: Get S$350 cash credit when you are one of the first 200 applicants to successfully apply for the UOB Absolute Credit Card and spend a min. of S$1,000 per month for 2 consecutive months from card approval date. Valid till 30 April 2025. T&Cs apply.

Remember, your wedding will be one of the most expensive expenditures in your life. So why not make your hard-earned cash work even harder by charging your wedding expenses to a credit card? Check out our latest promotions and deals today!

Similar articles

Best American Express Credit Cards in Singapore (2024)

What Are The Best Credit Cards You Should Be Paying Medical Bills With?

What Are The Best Credit Cards For Paying Education Expenses?

Get a Free Round-trip to Bali on Singapore Airlines with American Express

Promo: S$100 AirAsia Credit with American Express Credit Cards

Which Credit Card is Best to Buy Airline Tickets and Hotels?

AMEX Singapore Airines Business Credit Card: How Does It Stack Up Against Other Corporate Cards?

16 Best Credit Cards For Big-Ticket Items

.png?width=800&height=250&name=Rewards%20Upgrade%20Campaign_BLOGARTICLE_800x250%20(1).png)

.png?width=800&height=253&name=DBS-CC_Mar-30Apr_INBLOGBANNER_KV1_800x250%20(1).png)