Table of contents

1. GST Vouchers and Assurance Package (AP)

Increased cash payouts to combat GST Increase

In order to help Singaporeans defray the GST hike, the government the permanent GST Voucher scheme by increasing the number of Singaporeans who will benefit from it.

They will be increasing cash quantums to ensure that most retirees and lower-income households will not be impacted by the GST rate increase.

For those living in homes with annual values of up to S$13,000, the GSTV cash quantum will be raised from S$500 to S$700 in 2023, and to S$850 from 2024 onwards.

For those living in homes with annual values of above S$13,000 and up to S$21,000, the cash quantum will be raised from S$250 to S$350 in 2023, and then to S$450 from 2024 onwards.

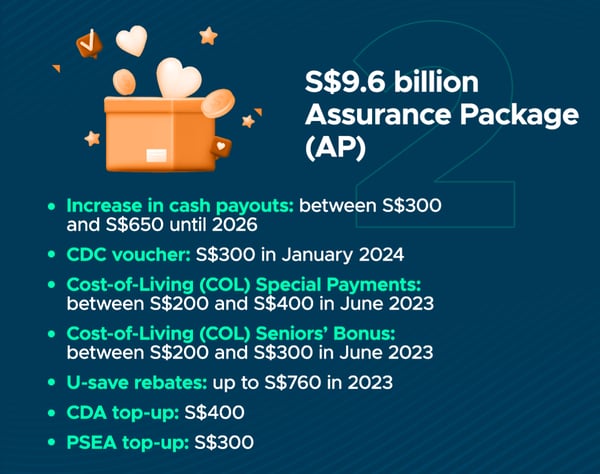

Additional S$300 to S$650 increase to Assurance Package (AP)

Mr Wong says he will increase the cash payouts to between S$300 and S$650 for eligible Singaporeans over the remaining years of the Assurance Package (AP), from 2022 to 2026.

This will bring the total AP cash payments to adult Singaporeans to between S$700 and S$2,250.

CDC Vouchers

There will also be an increase in the CDC voucher amount by S$100 in 2024. All Singaporean households can look forward to another S$300 of CDC vouchers in January 2024.

Again, these enhancements aim to offset additional GST expenses for Singaporean households for at least five years, and for about 10 years for lower-income households.

Cost-of-Living Special Payments

There will also be one-off cost-of-living special payments of between S$200 and S$400 for each eligible adult Singaporean.

He will also provide additional support for seniors and extend a cost-of-living seniors’ bonus of between S$200 to S$300 for eligible Singaporeans aged 55 and above.

U-Save Rebates

Eligible households can expect up to S$760 in U-Save rebates in 2023.

Child Development Account (CDA)

For households with children, each child up to six years old will get a S$400 top-up to his Child Development Account (CDA).

Children older than six will get a S$300 top-up to their Edusave or Post-Secondary Education Account (PSEA).

Overall, the Assurance Package will cost S$3 billion, raising the cost of the package from S$6.6 billion to S$9.6 billion.

Store your cash in a high-yield savings account to beat inflation!

2. For businesses

Click to jump to:- National Productivity Fund

- Enterprise Innovation Scheme

- Helping smaller firms to become profitable

- SME Co-Investment Fund

- Singapore Global Enterprises Initiative

- New 'job-skill' integrators

S$4 billion boost to National Productivity Fund

To anchor more quality investments in Singapore, S$4 billion will be added to the National Productivity Fund.

The fund provides grants for companies to invest in productivity, training and further education and expand to include investment promotion. This includes supporting companies to build new capabilities, value-add to domestic ecosystems, and upskill workers.

These efforts will lead to better-paying jobs for Singaporeans.

[NEW] Enterprise Innovation Scheme

This new Enterprise Innovation Scheme aims to enhance tax deductions of up to 400% for key innovation activities. This tax deduction is a 150% increase from the previous 250%.

The tax deductions will apply to the following activities:- Research & Development conducted in Singapore

- Registration of intellectual property, including patents, trademarks and designs

- Acquisition and licensing of intellectual property rights

- Innovation carried out with polytechnics and ITE

- Training via courses approved by SkillsFuture Singapore and aligned to the Skills Framework

The qualifying expenditure will be capped at S$400,000 for each activity. It will be capped at S$50,000 for innovation carried out with polytechnics and ITE.

These measures will allow businesses that make full use of the scheme to enjoy tax savings of nearly 70% of their investment.

Up to S$20,000 cash payout for unprofitable firms

Businesses will have the option to convert 20% of their total qualifying expenditure per year of assessment into a cash payout of up to S$20,000.

This supports firms that have yet to turn profitable or do not have sufficient profits to maximise the benefits from the tax deductions, he says.

It will also help smaller businesses defray the costs of their innovation activities, even if they pay little to no taxes.

SME Co-Investment Fund

To support small and medium-sized enterprises (SME) as they scale up, S$150 million will be added to the SME Co-Investment Fund.

The Government also aims to set aside an additional S$300 million of private investments to support these SMEs.

For example, when the Government dedicated S$1 billion to Heliconia Capital, an investment firm that focuses on growth-oriented Singapore companies, the total revenue of the 60-company portfolio more than doubled.

More than half of them developed new capabilities or expanded beyond Singapore.

S$1 billion boost scheme to help grow promising large companies

The Singapore Global Enterprise Initiative will help large Singapore companies receive a S$1 billion boost.

This initiative aims to provide customised assistance to promising large local enterprises by working closely with experts.

Enterprise Singapore also endeavours to assist firms in securing resources necessary to execute their growth plans, building research and innovation capabilities to remain competitive.

These schemes are part of wider measures to help nurture and develop enterprises to encourage innovation.

3. For employees

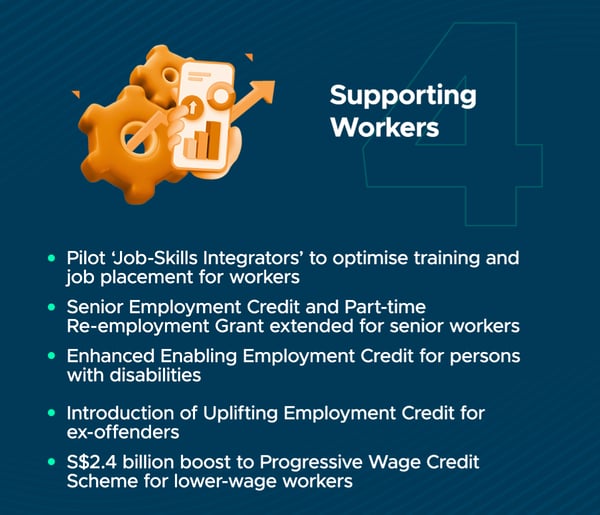

New ‘Jobs-Skills Integrators’ to streamline training programmes

There is a need for labour market intermediaries to optimise training and job placement to help workers find suitable training programmes for themselves.

These intermediaries, or Job-Skills Integrators, will be appointed to work with industry, training and employment facilitation partners, and deliver the following outcomes:

- Engage enterprises to understand the manpower and skills gap in the sector.

- Work with training providers to update existing training programmes, or develop new ones that will close the skills gap.

- Work closely with employment facilitation agencies, get buy-in from industry partners and unions, and identify individuals with the right aptitude. They must also ensure that training translates into better employment and earnings prospects.

This will be trialled in the precision engineering, retail and wholesale trade sectors, where there are higher concentrations of mature workers and SMEs.

Employment support for seniors extended to 2025

The Senior Employment Credit, which provides wage support to employers, will be extended to 2025.

Under this scheme, employers will be able to receive wage offsets when they hire Singaporean senior workers aged 55 and above, and earning up to S$4,000 a month.

To encourage employers to take up part-time re-emplyment and other flexible work arrangements for seniors, the Part-time Re-employment Grant will also be extended to 2025.

Lower-wage workers will continue to get career progression and wage support through the Progressive Wage Model, which was extended in 2022 to more sectors and occupations.

S$2.4 billion increase to the Progressive Wage Credit Scheme

The Progressive Wage Credit Scheme which aims at increasing wages for lower-wage workers will be topped up by S$2.4 billion. This means that the Government will continue to co-fund up to 75% of pay increases for workers earning a gross wage of up to S$2,500 a month.

A lower co-funding ratio will apply to those earning above S$2,500 and up to S$3,000.

4. Housing

Additional BTO ballot for first-time applicants

The Government will focus on supporting first-timer families with children, as well as young married couples aged up to 40 who are buying their first home.

More will be done to help such families secure their BTO flats including giving them an additional ballot for their BTO applications later in 2023.

Up to S$30,000 more in CPF Housing Grant for resale HDB flats

The CPF Housing Grant for eligible first-timer families buying four-room or smaller resale flats will be increased by S$30,000. The grant for those buying five-room or larger flats will also be increased by S$10,000. This is for eligible home buyers who submit their resale applications from 3.30pm on 14 February 2023.

This means that eligible families can receive up to S$190,000 when buying a resale flat with the grants provided.

Are you an aspiring homeowner? Check out the best home loan rates in the market to start your financial planning!

5. Family

Click to jump to:

- Working Mother's Child Relief

- Baby Bonus Cash Gift

- Child Development Account (CDA)

- Baby Support Grant

- Paid Paternity Leave

- Unpaid Infant Care Leave

- Comcare Endowment Fund

- KidSTART initiative

- More full-day childcare centres

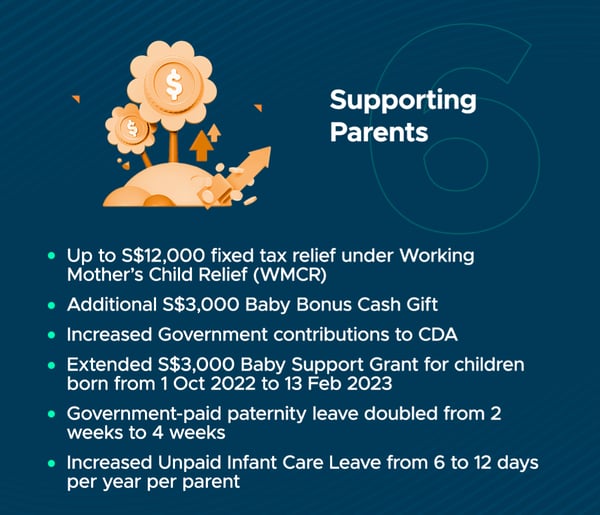

Up to S$12,000 fixed tax relief

For Singaporean children born or adopted on or after 1 January 2024, the Working Mother’s Child Relief will be changed from a percentage of the mother’s earned income to a fixed dollar relief, from 2025.

Eligible working mothers will soon be able to claim tax relief in the following amounts:

- First child: S$8,000

- Second child: S$10,000

- Third and subsequent child: S$12,000

Additional S$3,000 Baby Bonus Cash Gift

The Baby Bonus Cash Gift for all eligible Singaporean children born from 14 February 2023 onwards will be increased by S$3,000.

- First and second children: S$11,000.

- Third and subsequent child: S$13,000

Eligible parents can expect up to S$9,000 in payouts in the first 18 months of a child’s life, as well as S$400 every six months from when the child is 2 years old until 6½ years old.

Increased support to offset pre-school and healthcare expenses

Government contributions to the Child Development Account (CDA) will be increased for eligible Singaporean children born from 14 February 2023 which can be used by parents to directly offset preschool and healthcare expenses.

The First Step Grant will be increased from S$3,000 to S$5,000, and increase its co-matching cap by S$1,000 each for the accounts of a couple’s first child and second child.

Enhancements to the Baby Bonus cash gift, CDA First Step grant and CDA co-matching caps will commence in early 2024.

Extended Baby Support Grant

The Government will extend the one-off Baby Support Grant of S$3,000 to babies born from 1 October 2020 to 13 February 2023.

Doubled paid-paternity leave

The government-paid paternity leave will be doubled from 2 weeks to 4 weeks for eligible working fathers of Singaporean children born on or after 1 January 2024.

During this scheme's initiation, the extra two weeks will be voluntary. Any employers intending to grant the additional leave will be reimbursed by the Government.

The voluntary starting period also provides employers more time to adjust.

But the Government will review this over time and will make this mandatory in the near future.

Unpaid infant care leave to increase

Unpaid infant care leave for each parent in their child’s first two years will be doubled to 12 days per year. All parents of Singaporean children will be eligible for this additional time off if they have worked with their employer for a continuous period of at least three months.

This will commence from 1 January 2024, for eligible working parents with Singaporean children aged under 2 years old.

These leave enhancements will increase parental leave for a working couple from 22 weeks to up to 26 weeks in their child’s first year to support the child and the mother.

S$300 million top-up to ComCare Endowment fund

ComCare aims at providing lower-income families with social assistance to help families meet basic living expenses and work towards achieving stability and self-reliance.

To ensure that the fund will be able to provide the necessary support in this high-inflation environment, the ComCare Endowment Fund will be topped up by S$300 million.

[NEW] KidSTART for lower-income families

KidSTART aims to support pregnant mothers and young children in lower-income families. The Government will scale up KidSTART nationwide to support 80% of eligible children in lower-income families, starting from children born in 2023.

22,000 more full-day childcare centres

Anchor operators will create 22,000 more full-day childcare places and expand the number of MOE Kindergartens to support higher pre-school participation rates, especially among lower-income families.

Check out the best credit cards for attractive rebates and sign-up rewards!

6. CPF and other funds

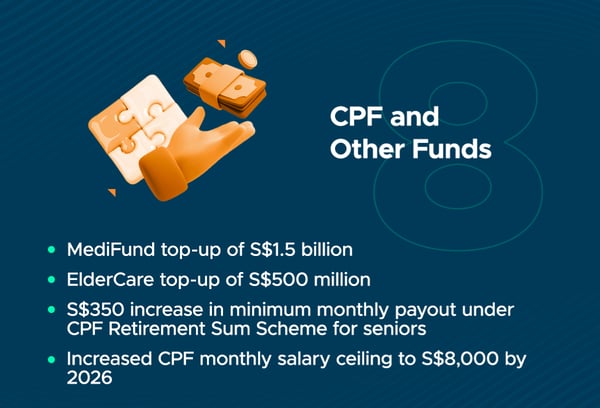

S$1.5 billion increase to MediFund

MediFund will be topped up by S$1.5 billion to strengthen the safety net for lower-income individuals and seniors facing financial difficulties with their medical bills, even after government subsidies, MediShield Life and MediSave.

S$500 million increase to ElderCare Fund

The ElderCare Fund will be topped up by S$500 million to support means-tested subsidies and other necessary resources for seniors who require home-based, centre-based or institutional care.

Increased minimum monthly payout for seniors to S$350

The Government will continue with the next increase in CPF contribution rates in 2024 for senior workers aged 55 to 70 from 1 January 2024, to enhance retirement adequacy.

As with previous increases, employers will be provided with the CPF Transition Offset to deal with business costs arising from this increase.

The minimum CPF monthly payout for seniors on the Retirement Sum Scheme will also be raised to S$350 a month.

CPF monthly salary ceiling to be raised to S$8,000

The CPF monthly salary ceiling will be raised to help middle-income Singaporeans save more for their retirement. The monthly salary ceiling will be raised from S$6,000 to S$8,000 in 2026.

From September 2023, the increases will be phased over four years to allow employers and employees to adjust to the changes.

7. Donations, volunteering, & social work

Extended tax deduction rate for eligible donations

The 250% tax deduction rate for donations to Institutions of a Public Character (IPC) and eligible institutions will be extended until the end of 2026.

Enhanced Corporate Volunteer Scheme

The Government will enhance the Corporate Volunteer Scheme, which will be rolled out for three years. The expanded scope of eligible activities includes off-site and virtual activities.

The Government will also double the qualifying cap per institution of public character (IPC) to S$100,000 per calendar year.

Increased salaries for social service sector

The Government will work with agencies to raise salaries to better attract and retain talent.

S$1 billion top-up to the Community Silver Trust

The Government will top up the Community Silver Trust by S$1 billion to support social service agencies that deliver community care services for seniors.

The trust provides dollar-for-dollar donation matching grants to these agencies and will enable them to enhance the quality and accessibility of community care.

S$10 million top-up for Self-Help Groups

Singapore's four ethnicity-based Self-Help Groups – the Chinese Development Assistance Council, MENDAKI, SINDA and the Eurasian Association – will also receive a S$10 million top-up over the next three years, until 2026.

Check out the best credit cards for attractive rebates and sign-up rewards!

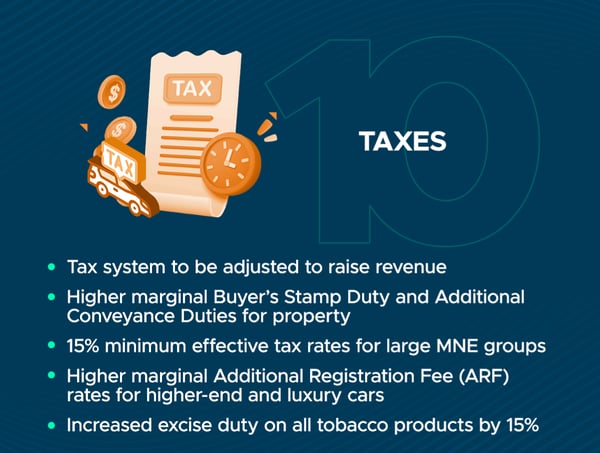

8. Income, Property, Luxury Car, Tabacco Taxes

Higher marginal buyer's stamp duty rates

Increased taxes for luxury cars

Tax hike on tobacco products

15% minimum effective tax rate for large MNE groups

A global minimum effective tax rate of 15% will be introduced for large multinational enterprise (MNE) groups here, from 2025.

Singapore’s corporate tax system will be affected by international taxation rules such as the Global Anti-Base Erosion rules under Pillar 2 of the Base Erosion and Profit Shifting initiative (Beps 2.0).

The Government will monitor international developments and adjust its implementation timeline if there are delays to Beps 2.0.

The Government will also review and update its suite of industry development schemes to ensure Singapore remains competitive in attracting and retaining investments.

Reduced balances in Contingencies Fund

In May 2020, the Government raised the Contingencies Fund balance from S$3 billion to S$16 billion to ensure it could respond quickly during the pandemic.

With the return to normalcy, the Contingencies Fund balance will be reduced to S$6 billion.

The Government will table a Bill to amend the Constitution to reduce the balances in the Contingencies Fund because there is no legal mechanism to do so now.

The Bill’s first reading will take place later in February 2023.

A little red dot with big dreams

Budget 2023 will help Singaporeans tide over immediate cost-of-living pressures, grow the economy, assist workers, strengthen Singapore’s social compact, and continue to build a more resilient nation.

“We are a little red dot - a country that was never meant to be,” he says, adding that Mr Lee Kuan Yew and the pioneer generation set the tone for how Singapore should respond to adversity - “with grit and tenacity, and with the courage to dream big and to turn these dreams into reality”.

Singapore's origin story from a small, humble fishing port to a bustling metropolitan hub of international trade, we have come far on our journey of independence – and will continue on this road with grit and tenacity for the years to come.

Read these next:

Singapore Budget 2022: 6 Ways It Will Impact You

Singapore Budget 2022: Key Highlights And Summary

Singapore Budget 2022: 4 Small Sacrifices You Can Make To Defray The Upcoming GST Hike

Singapore Budget 2022: GST Hike — Increase in GST And Packages To Offload The Financial Burden

Singapore Budget 2022: 6 Things You Didn’t Know You Could Spend Your CDC Vouchers On

Singapore Wealth Tax: How Rich Must You Be To Be Affected?

Similar articles

A Look Back At Singapore Budget 2020 Highlights

Best Infant Care & Childcare in Singapore (2023) – Fees & Subsidy

Singapore Budget 2020: Summary And Key Highlights

Singapore Budget 2023: Key Impacts Affecting Inflation, Employees, and Businesses

Singapore Budget 2021: Key Highlights And Summary

INFOGRAPHIC: Singapore Budget 2017 By the Numbers

Singapore Budget 2022: Key Highlights And Summary

Singapore Budget 2023: GST Vouchers & Household Support Guide